The Remazing News Package: Fee increase for FBA sellers & tax avoidance in Europe

In the past two weeks, there has been good and bad news from Amazon. The good news first: The platform is the most important product search engine in the U.S.

On the opposite side, Amazon is facing accusations of tax avoidance, some of which are justified. The company is also struggling with rising logistics costs due to current global crises – and is passing them on to sellers on its platform with another increase of FBA fees.

Despite all the current supply chain problems, it is exciting to note that Amazon has recently started marketing its own logistics services to D2C brands with its new “Buy with Prime” program.

Updates: Amazon

Fee increase for FBA sellers: fuel and inflation surcharge

In response to rising costs, Amazon is adding fuel and inflation surcharges for FBA sellers in the U.S. starting this week – and in EU5 markets starting May 12. The group is slapping on 5% per unit, which means an average increase of about $0.24 and €0.13, respectively. However, this is only half the surcharges levied by other major logistics providers, Amazon says. For FBA sellers, this is the second fee increase within a short period of time: earlier this year, costs were raised by 5.2% in the U.S. and 6% in Europe.

“Buy with Prime”: Amazon takes advantage of growing D2C trend

Amazon has launched another update aimed at the “direct-to-consumer” (D2C) boom in the U.S.: The new “Buy with Prime” program enables the logistical processing of orders in 3rd party online stores through Fulfilment by Amazon (FBA). Ordered products must already be available in an Amazon warehouse and the customers have to be Prime members though. The launch of “Buy with Prime” in Europe is probably only a matter of time.

Amazon is the most important product search engine in the U.S.

In its “Amazon Consumer Behavior Report 2021”, Feedvisor surveyed 2,000 people in the U.S. about their buying behavior on the e-commerce platform. One of the many interesting findings of the survey: only 18% of respondents start searching for products on Google, while 62% use Amazon directly as a search engine for online purchases. According to the report, the price of a product is the first thing that catches the eye of most consumers, with product images being the second most important detail. The title of an offered product only follows in third place.

Incorrect tax calculation for deliveries to the UK

Amazon’s VAT calculation service VCS has most likely miscalculated the tax charges for shipments to the UK: UK sales tax must be paid on shipments worth more than £135, but according to reports, the VCS does not take this into account. Affected merchants who have used the Amazon service and shipped shipments over £135 to the UK should therefore be sure to double-check their remitted VAT.

Did Amazon not pay taxes in Europe in 2021?

According to a news report that originally was published on Bloomberg, Amazon did not pay any taxes for its business operations in Europe last year. The news, which was picked up and shared by many media outlets, was rejected by the company though: Amazon stated that its Luxembourg-based EU entity had “only” avoided paying corporate income tax as it officially recorded a loss. The remaining due taxes in the amounts of several million Euros, as well as the taxes of sub-entities registered in e.g. Germany, were paid according to Amazon. Even though these tax payments were erroneously not picked up by the media, the original news report once again – and overall justifiably – showcased one of Amazon’s corporate weak points.

Chinese sellers want to diversify their international e-commerce channels

Iscriviti ora alla nostra newsletter e ricevi aggiornamenti regolari su Amazon e altri mercati online.

Iscriviti subito alla Newsletter

Although Amazon remains the primary sales channel for Chinese brands and online sellers to reach consumers in Western markets, the Chinese Ministry of Commerce has called for international e-commerce to be “de-Amazonized.” Many sellers on the platform would certainly be pleased with less competition, yet a large number of Chinese sellers are still active on Amazon.

What caught our attention

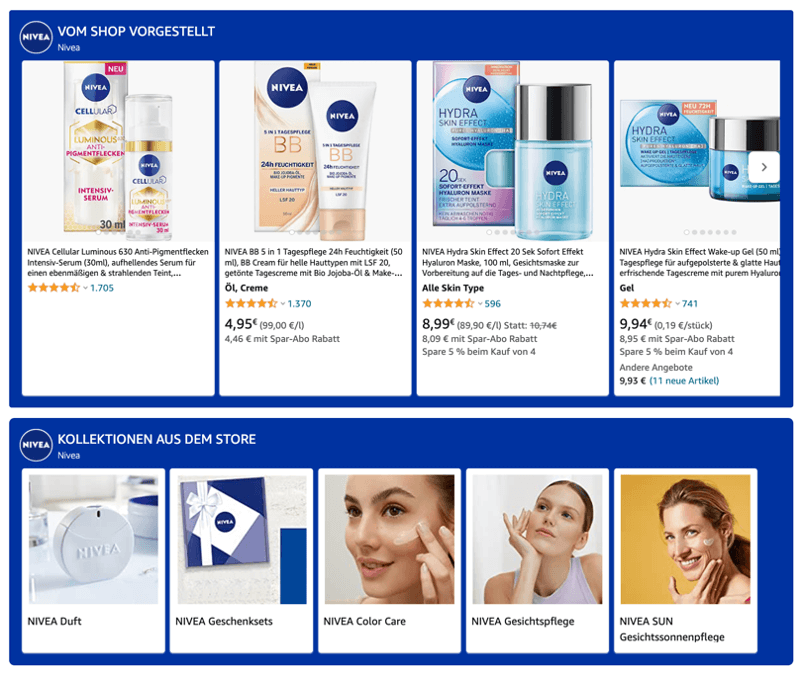

Our Remazing team has once again discovered new organic modules on Amazon Germany’s search results page: “Featured by Store” (“Vom Shop vorgestellt”) puts the focus on individual products and leads to the respective PDPs, while “Collections from the Store” (“Kollektionen aus dem Store”) shows the various subpages in the Brand Store and links to them.

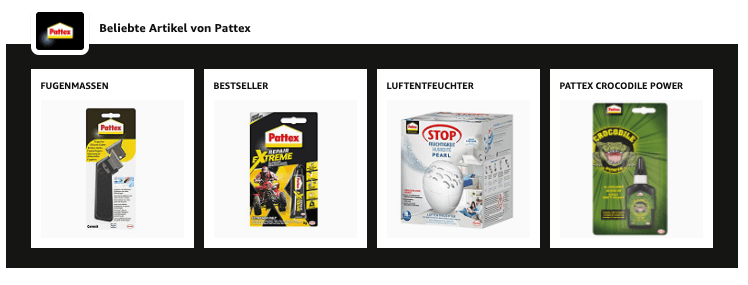

There is also a new organic module on the product detail page on amazon.de: “Popular items from X” (“Beliebte Artikel von X”) shows more products from the respective brand and links to the PDPs. The individual products and the categories they are assigned to seem to be automatically generated by Amazon from the Brand Store.

There was also a recent advertising update: Video formats will soon be usable in Sponsored Display campaigns. However, the feature is currently still in preview mode.

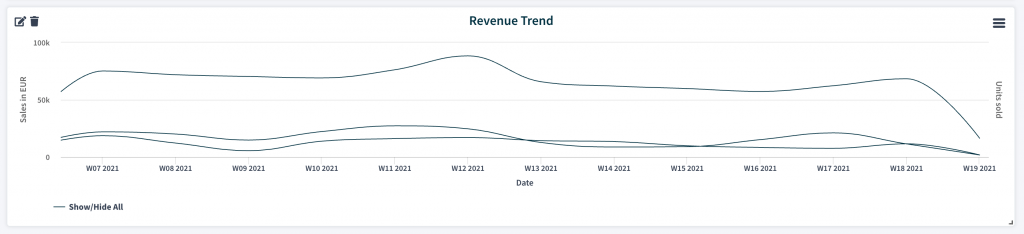

Remdash: Vendor & Seller Central Revenue

With Remdash it is possible to track your own revenues from Vendor Central and Seller Central:

- Filter Ordered Revenue vs. Shipped COGS

- Compare product groups

- Compare individual ASINs

- Compare global sales with sales on individual national marketplaces

Interested in Remdash?

Just click here to schedule a personal product demo with our team.

Top 5 Amazon Keywords

While Amazon users in Spain and the US are preparing for Mother’s Day on May 8, search terms in Germany and the UK have recently been dominated by TV series and movies. The influence of Prime Video seems to be evident here: British online shoppers searched for “James Bond” – a film series owned by MGM Studios, which was recently acquired by Amazon.

Sei interessato/a a ricevere un'analisi professionale gratuita del tuo Account Amazon?

Richiedi ora una valutazione gratuitaRemazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH