Here’s How Q4 2022 Went in International E-Commerce

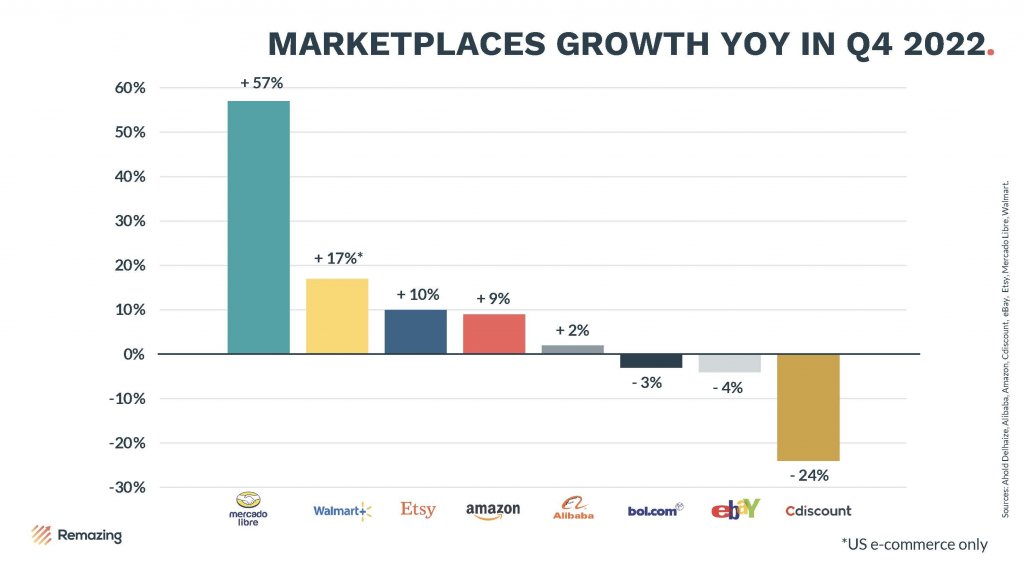

In recent days, many of the major online marketplaces have released their Q4 results. Q4 2022 was certainly not an easy quarter for the e-commerce industry, however the majority of the marketplaces still reported a slightly higher-than-expected growth rate.

Amazon, which only came in fourth, is already wanting to counteract the slowing growth and is focusing on expanding its same-day delivery service this year. Offering Prime services, such as quicker delivery times, also seems to be of interest to Shopify – the software provider is said to be considering offering a “Buy with Prime” option on its platform.

In other news, Amazon seems to have secured another leap into the US health care sector as it completed its acquisition of healthcare service OneMedical.

Finally, thanks to a reportedly $14 million ad during the Super Bowl, Chinese low-cost marketplace Temu saw its app overtake Amazon and Walmart to climb to number one on the list of most downloaded apps in the US.

Updates: Amazon

Amazon Seals Acquisition of One Medical

Last week, Amazon announced that it had completed its $3.9 billion acquisition of healthcare provider OneMedical. After the e-commerce giant agreed to the acquisition in July 2022, the Federal Trade Commission (FTC) conducted an in-depth review of the merger. According to the FTC, it is still investigating circumstances such as potential harm to consumers from Amazon’s access to their health data held by One Medical and may file a lawsuit to reverse the merger at a later date. However, the deadline for challenging the initial deal has passed, so Amazon could now go through with the acquisition.

Expansion of Amazon’s Same-Day Delivery Service in the U.S.

Amazon plans to invest in its same-day delivery service in the U.S. to expand its specialized fulfillment center footprint. In addition to its 46 active sub-same day delivery locations, the company plans to build and operate a further 150 facilities. Each of these sub-same day delivery locations is a combination of a mini-fulfillment center and a delivery station. Their expansion is intended to provide Amazon customers in major U.S. cities with a choice of over 100,000 items that can be delivered within 5 hours. Due to increased economic and competitive pressure, Amazon is probably banking on its biggest unique selling point with this expansion: fast delivery (see Fact of the Week).

Shopify Considers “Buy with Prime” Integration

In recent discussions with Amazon, Shopify’s decision-makers expressed interest in introducing a “Buy with Prime” option, a feature that allows merchants to provide their customers with Amazon Prime benefits, such as faster shipping, when selling products on websites outside Amazon’s ecosystem. Many analysts call the feature “a Trojan Horse”, pointing to Shopify’s potential loss of revenue and control over customer relationships – the latter being the aspect that online retailers particularly value about the platform. It remains to be seen if and under which terms the two companies could come to an agreement.

Updates: E-Commerce

Temu Is Outshining Amazon, Walmart & Co.

Thanks to a Super Bowl advertising supposedly worth $14 millions, Temu became the most downloaded app in the U.S., surpassing Amazon and Walmart. The Chinese e-commerce platform offers a broad selection of products, similar to Wish or AliExpress, at prices considerably lower than those of numerous Western retailers. Its fashion offer costs on average 25 % less than Shein’s, making Temu a worthy competitor to the company. However, time will tell whether Temu can sustain its significantly low prices, free shipping, and additional benefits in the long run.

Instagram Stops Live Shopping

Following the removal of the shopping tab, Instagram, owned by Meta, is continuing to deprioritize shopping on its app by shutting down the livestream shopping business, which used to be available to U.S. businesses and creators since 2020. From March 16, 2023, it will not be possible for Instagram users to tag products during live-streaming. Proven to be extremely successful in Asia, livestream shopping has not been profitable enough in western markets, which is often justified by cultural differences in digital habits and shopping behavior.

What Caught or Attention

Amazon seems to be testing a kind of label on the Spanish marketplace that indicates when a product has already been viewed. We have yet to notice this labe appear on other marketplaces.

Commentary: Mixed Earnings for Online Marketplaces in Q4

Abonnez-vous à notre newsletter pour recevoir régulièrement des informations sur Amazon et autres plateformes de commerce en ligne.

S’abonner à la newsletter.

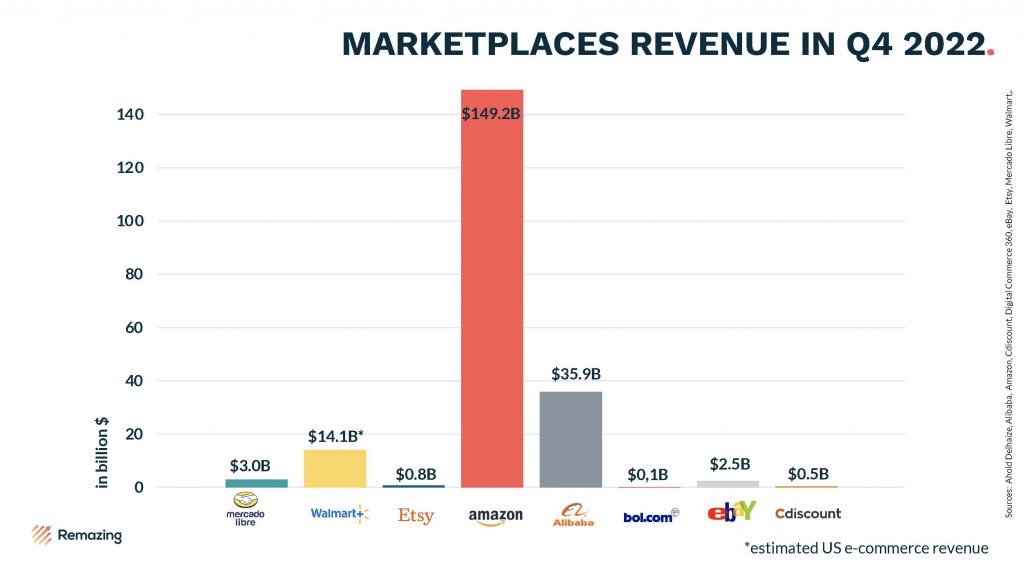

In the past weeks, many of the big players in global e-commerce published their financial results for Q4 2022. Compared to the other online marketplaces, Amazon did not report the biggest growth and finds itself with + 9% year over year “only” in fourth place. But, as always, the platform is still beyond comparison when taking its quarterly revenue (see image two) into consideration.

- Once again, Argentinian e-commerce company Mercado Libre – sometimes called ‘the Amazon of Latin America’ – shows the highest quarterly growth (+ 57% yoy), followed by Walmart’s U.S. e-commerce division (+ 17% yoy). Both marketplaces have their (main) businesses in markets on the American continent which seem to have made a quicker recovery from recent economical challenges than most parts of the world.

- Some of the marketplaces we analyzed noted declines in growth: bol.com, eBay, and cdiscount. All of them are relative household names in Europe and had to contend with the economic consequences of many EU core markets being hit strongly by inflation and the energy crisis.

What we can clearly see is that the European markets have been struggling more through the economic crisis compared to other overseas markets. But although it was not an easy quarter in e-commerce, most of the marketplaces still reported a higher-than-expected growth rate in Q4 2022.

Fact of the Week

The most frequently-cited advantages of Amazon are mentioned in the same order in all of the surveyed countries from our International Amazon Shopper Report 2022: “Fast delivery” is in first place with 73%, Amazon’s “large selection of products” in second place (60%), and the “low prices” is only the third most important factor mentioned by 54% of the respondents.

In comparison, French Amazon shoppers said they appreciated fast delivery the most (79%), while this is a less relevant factor for many Italian customers (66%) (Source: International Amazon Shopper Report 2022, Remazing & Appinio).

Remdash: Content Management System

High-quality content is the foundation for success on Amazon and other online marketplaces. Remdash’s CMS enables you to quickly create and store premium content.

- Design your own custom CMS with the input fields your team requires

- Create content more quickly with the image gallery, PDP, and A+ builders

- Store your content in any language and collaborate with one click

Interested in Remdash?

Just click here to schedule a personal product demo with our team.

Top 5 Amazon Keywords

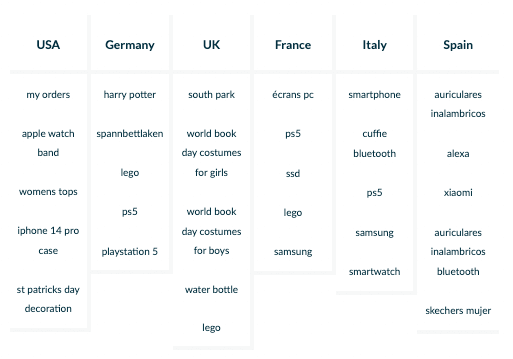

These are the top 5 most searched keywords by country from February 19-25, 2023.

Last week, Amazon users in the U.S. were increasingly looking for decorations for St. Patrick’s Day. Meanwhile, in the UK, there was an increase in searches for Book Day costumes, a charity day when children dress up as some of their favorite book characters.

Êtes-vous intéressés par une analyse experte de votre compte Amazon ?

Demander une analyse gratuite

Autres articles associés

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH