Here’s how Q3 went for Amazon, eBay & Co.

Two weeks ago, Amazon published its quarterly figures. Because they were somewhat weaker than expected, they triggered a drastic slump in the shares and stock market value of the U.S.

At the same time, Amazon is expanding one of its most profitable businesses with new advertising features and plans to enable payments via the PayPal service, Venmo, on its U.S. marketplace in time for Black Friday. Additionally, it will now be possible to try on sunglasses for sale on Amazon via the social media platform Snapchat, using a filter. The Chinese marketplace Alibaba, on the other hand, is taking a much bigger step in the direction of augmented reality and is even opening a virtual shopping mall for the Global Shopping Festival on November 11.

Remazing in the News

Remazing Wins the International APPEALIE SaaS Award with Remdash!

Read now

Updates: Amazon

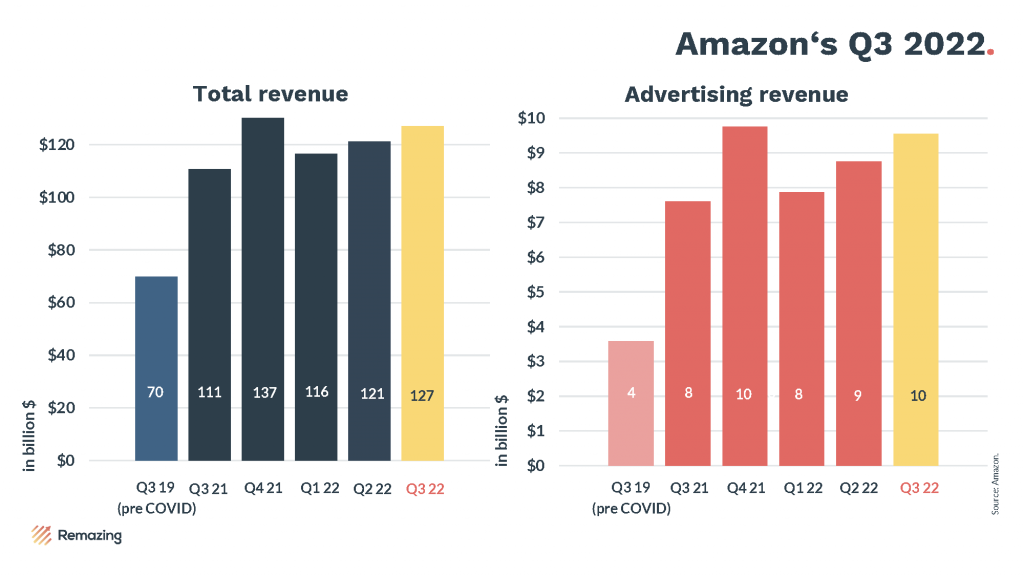

Amazon’s “Poor” Performance in Q3

Recently, after Amazon released its Q3 2022 results, shares fell nearly 20%. Although sales increased by 15% YoY, Amazon still fell short of experts’ expectations. As a result, Amazon’s stock market value fell below $1 trillion for the first time since 2020. However, an analysis by Marketplace Pulse shows that Amazon’s growth is in line with the overall e-commerce trend, which is settling into a normal, steady growth rate after the Coronavirus boost. Remazing Managing Director Hannes Detjen provides our assessment of this development in the commentary towards the end of the newsletter.

Amazon’s Response to Crisis Situation: Extended Hiring Freeze & Cash Advances

Due to the current tense economic situation, Amazon plans to suspend the hiring of new employees in all of its divisions – no longer just in advertising – as part of cost-cutting measures. To support small and medium-sized businesses, Amazon is also introducing a financing solution in the US. The merchant loan program offers a cash advance for sums ranging from $500 to $10 million, tied to a portion of future sales at a fixed fee. The program is said to have no fixed term, personal guarantee, credit check or late fees attached. In a more negative light, there are reports that Amazon has drastically reduced warehouse capacity for some FBA sellers.

Amazon Expands Advertising Options On- and Offline

At its “UnBoxed” advertising conference at the end of October, Amazon introduced new advertising features. For example, users can now create Sponsored Display Video Ads on their own, using templates from Amazon’s Video Builder (beta). Amazon is also opening up its DSP for displays in its own “Amazon Fresh” supermarkets, thus entering the “Digital out of Home” (DooH) market. Overall, it is clear that Amazon Ads wishes to make its ads as accessible as possible to sellers, with these adjustments which make them easy to create. After all, advertising is one of the most profitable areas of the group, as the current Q3 results also show.

Amazon to Accept Payments via Venmo in the U.S.

With the start of Black Friday at the end of November this year, it will be possible in the U.S. to make purchases on Amazon.com and in the Amazon app via the mobile payment service provider Venmo, a service from PayPal. For the time being, the offer will only be possible for a selection of the nearly 90 million active Venmo users; according to PayPal, the rollout has already begun this week.

Updates: E-Commerce

A Largely Successful Q3 for eBay, Zalando & Co.

At $2.4 billion, eBay records a 5% year-on-year (YoY) decline in sales. Fashion marketplace Zalando, on the other hand, can boast revenue growth of 2.9% YoY. After Shopify released its Q3 numbers with a smaller than expected loss and revenue growth of 22% YoY, the group’s shares rose 17%. DIY marketplace Etsy enjoyed a similar success: share values rose by 10% after the company released successful third quarter figures with 11.7% revenue growth YoY.

Shopping Experiences of the Future with Amazon and Alibaba

At the Global Shopping Festival on November 11, Alibaba will offer an online shopping street where users can virtually browse and shop. Sales of luxury goods using 3D and AR have already seen double-digit year-on-year growth, according to Alibaba. While the Chinese e-commerce giant is opening a virtual shopping mall, Amazon is cautiously feeling its way into the world of AR and has recently enabled Snapchat users to try on virtual glasses directly in the app.

New Online Marketplaces from China on a Collision Course with Amazon?

In recent months, Pinduoduo and ByteDance, the parent company of TikTok, have opened international e-commerce platforms to boost sales of Chinese products in America and Europe. The overseas expansion puts both companies in direct competition with Amazon. ByteDance has launched the fashion website, If Yooou, while Pinduoduo has opened an online marketplace called Temu, offering items in a wide range of categories from sports to electronics. This follows the trend of China’s two largest e-commerce companies, Alibaba and JD.com.

Google Offers New Shopping Features

The search engine is launching more new shopping features in the US. The e-commerce offensive could be due to the fact that Amazon enjoys greater popularity than Google for product searches, as our Amazon Shopper Report 2022 shows. Google plans to display discount codes directly in the search results so that they can be applied easily by copying and pasting. Further functions for comparing offers and prices have also been announced. Whether or not and when the innovations will come to Europe has not yet been determined.

Our Amazon Shopper Report 2022 for Spain, France & Italy

Together with Appinio, we surveyed consumers about their online shopping behavior, particularly on Amazon. In addition to the German version, the resulting report is now also available with local insights in Spanish, French, and Italian. The results contain some surprising insights, but above all show how strongly Amazon dominates European online retail.

Suscríbete a nuestra Newsletter ahora y recibe actualizaciones periódicas de Amazon y otras plataformas de e-commerce.

Suscribirse a la Newsletter ahora.

For a quick overview of the results, we recommend the media coverage of our study over the past few days. Among others, the Amazon Shopper Report 2022 was picked up by Marketing Directo in Spain and Ecommerce Hub Italy.

What Caught our Attention

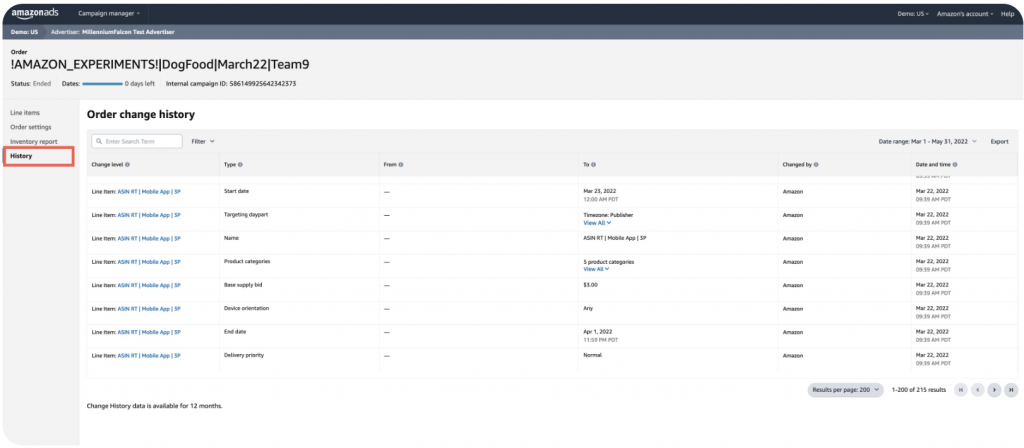

Amazon has announced two new features in its Demand Side Platform (DSP):

- Advertisers in the US can now use Audience Research (beta) to get advance feedback from potential customers on their campaigns. The tool can be used to design trial campaigns, send them to people in the relevant target groups, and view reports on their performance.

- In addition, users can now view the historical record of DSP campaign changes. The feature is designed to enable advertisers to draw conclusions from fluctuations in ad performance to changes in campaigns.

For Sponsored Brand Ads, there is now an “Assigned Purchases” report type in the Advertising Console. This makes it possible to track which ASINs were purchased through a self-service campaign — both actual advertised ASINs and those that benefited from a “brand halo” effect.

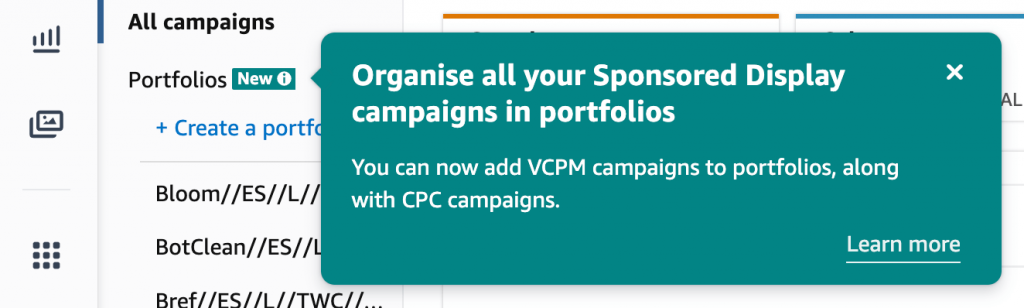

Sponsored Display-Kampagnen können nun sowohl im CPC- (Cost per Click) als auch im vCPM-Abrechnungsmodell (Cost per thousand viewable impressions) zu Portfolios hinzugefügt werden. Dadurch können Werbetreibende jetzt ihre CPC-basierten Sponsored Display-Kampagnen mit anderen Werbekampagnen in Sammlungen organisieren, die die Struktur ihres Unternehmens mit Portfolios widerspiegeln.

Commentary: Amazon’s Performance in Q3 2022

Amazon published its results for the third quarter at the end of October. Afterwards, the shares plunged by almost 20%, but how serious is the situation, really?

Amazon’s revenue grew 15% year over year to $172 billion. Growth was driven primarily by US e-commerce (+20% year over year) and advertising (+25% YoY). International sales declined (-5% YoY), largely due to the strong dollar and core European markets suffering from inflation and the energy crisis.

Our three observations on this development:

1. Does this reflect reality?

Amazon’s stock market valuation is back to pre-Corona pandemic levels (~$1 trillion), but Amazon’s revenues last quarter were nearly double what they were in Q3 2019 (pre-Corona).

2. Impressive advertising growth.

+25% ad growth is huge, especially when you look at the other major ad platforms’ Q3 numbers: Alphabet (Google) +3%, Meta (Facebook) -4%! Amazon now generates more than a third of Meta’s ad revenue and is taking market share away from the big players.

3. Stable growth forecast.

Q4 revenue growth is expected to be up to +8% in a very challenging market environment. One might assume that other e-com players will present significantly worse figures.

Overall, we see that the financial crisis is also hitting Amazon. However, we are rather positively surprised by the results and see the development less dramatically than the market did at the beginning of the year.

Fact of the Week

Top 5 Amazon Keywords

These are the top 5 most searched keywords by country from October 30 to November 5, 2022.

Little by little, Christmas spirit seems to be setting in across all Amazon markets we analyzed: in the USA, Germany, the UK and France, shoppers on Amazon were increasingly looking for Christmas decorations and Advent calendars. Italian Amazon shoppers were also already on the lookout for the first Black Friday deals.

¿Estás interesado en un análisis experto de tu cuenta en Amazon?

Solicitar análisis gratuitoArtículos relacionados

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH