Amazon’s Q4 & Full Year 2022 – as Bad as Expected?

Amazon recently released its 2022 results, showing clear growth in a year that tested the entire e-commerce landscape. Net sales increased 9% to $149.2 billion in Q4 2022, driven primarily by its advertising business and online sales in the U.S.

Despite overall declining growth, Germany remains the strongest Amazon marketplace outside the U.S., closely followed by the UK. According to a study by Jungle Scout, most sellers on the platform worldwide are starting the 2023 financial year profitably, despite the increase in fees taken by Amazon. The majority of those surveyed also plan to further expand their advertising activities this year. In our third annual “Amazon Merchant Survey,” we would also like to learn more about the expectations of brands on Amazon in 2023. More on that later in the newsletter.

Outside of Amazon, the colorful online marketplace hustle and bustle continues: Kaufland is expanding its existing offering, and BestSecret is turning its fashion platform into a marketplace. Meanwhile, Walmart announced plans to make changes to their platforms.

Our Amazon Merchant Survey 2023

As part of our annual survey, we are curious about what developments merchants expect for their Amazon e-commerce activities in 2023. For this purpose, we have compiled a short questionnaire and would appreciate your participation. To the questions.

Answering the questions will take no longer than 5 minutes – thank you in advance for your support!

For further reading: The results of our Amazon Merchant Survey 2022 can be found here.

Updates: Amazon

Amazon Cuts ties with EU Vendors to focus on branded goods

On Wednesday, Amazon informed EU distributors that they would no longer source their products, to now focus on obtaining products from brands directly. This means that wholesalers who have been selling their products on Amazon’s platform and wish to maintain their business relationship with Amazon will be required to operate as third-party sellers through Amazon’s marketplace. This is likely another cost-controlling measure. By cutting out middlemen within the value chain, Amazon is able to exert more control over its relationships with the remaining brands, increasing its control over costs and product selection. Experts are two-minded about this update. On one hand, brand owners will no longer have to compete with other vendors selling the same products. On the other hand, this could negatively impact the availability of goods for customers.

Despite Rising Fees, 89% of Amazon Sellers Start 2023 Profitably

According to a study by Jungle Scout, 89% of Amazon Sellers entered the fiscal year 2023 profitable. That’s 4% more than the year before. The study also found that despite rising costs, nearly 40% of Sellers increased their profits in 2022. The majority of respondents also plan to expand their international presence and diversify their marketing strategies in the coming year. In addition, the costs Sellers pay to sell on Amazon have also continually increased over the years: More than 50% of the revenue generated now goes to the platform – including FBA, advertising, and referral fees.

Amazon Plans More Brick-and-Mortar Supermarkets in 2023

As CEO Andy Jassy recently announced, Amazon plans to focus on grocery stores in its offline business this year. He said that a lot of testing is already underway and the company is ready to implement successful features shortly. In 2017, Amazon acquired Whole Foods, but the offline food business currently accounts for only 3.4% of their total business. Our Amazon Shopper Report also showed that Amazon still has the greatest catch-up potential in the grocery sector.

Despite Shrinking Growth, Amazon.de Remains Strongest Foreign Amazon Market

Amazon’s recently released Q4 results and figures for the full year 2022 show that sales at Amazon Germany fell by around 10% last year. This can be attributed in part to the end of the pandemic online boom and the tight economy. Nevertheless, Germany remains Amazon’s strongest foreign market and is thus ahead of the UK with a growth decline of “only” 5.7%. Positive growth rates were recorded, for example, by Japan (12.7%) and the top-ranked USA (13.4%).

Updates: E-Commerce

Online Marketplaces: BestSecret Opens & Kaufland Expands

Online retailer BestSecret, which offers designer fashion at outlet prices to an exclusive group of members, has now announced that it will transform its German online shop into a marketplace. The platform is set to launch in 27 European markets later this year. Supermarket chain Kaufland has now launched its online marketplace in Slovakia, with the Czech Republic planned as the next market. In Germany, the marketplace already has 32 million monthly visitors and also offers its retailers services such as advertising opportunities and payment processing.

Walmart Offers Incentives to New Merchants

Walmart intends to continue expanding its online marketplace and wants to bring more merchants onto the platform. To make the marketplace more attractive and easier to get started, the company has now introduced various benefits and incentives such as the “New Seller Savings” discount, end-to-end fulfillment services and an automated pricing tool. At the same time, however, Walmart is now announcing that it is saying goodbye to its pick-up stores without retail salesrooms and is closing the last of its pick-up and delivery stores in the US.

Survey: Consumers Prefer Price Advantage to Favorite Brand

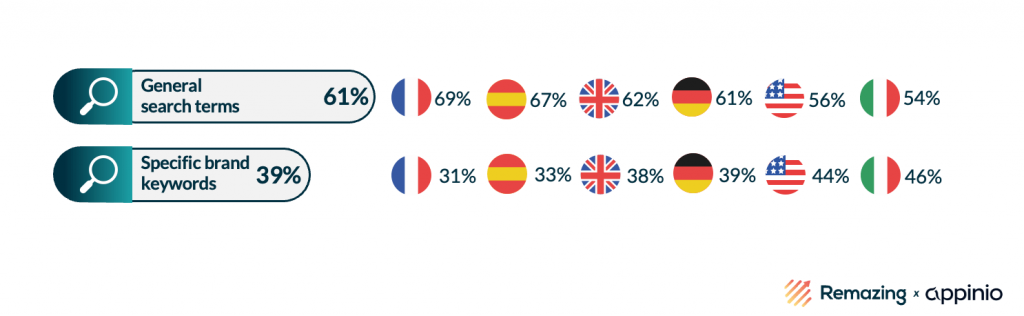

While prioritizing low-cost offers and convenient shopping experiences is on the rise, loyalty to favorite brands is taking a back seat. This is shown in a study by Mirakl, in which 43% of the 9,600 participants surveyed worldwide said they had stopped shopping with a particular brand manufacturer due to rising prices. On Amazon, the tendency to search for the best deal rather than brands has been evident for some time: our Amazon Shopper Report 2022 found that 61% of shoppers in Amazon’s main markets search for generic terms rather than brand keywords.

What Caught our Attention

Amazon has introduced a new API feature to update Video Advertising Creatives for live Sponsored Brands campaigns. 3P integrators can now update the Ad Creatives of already live Sponsored Brands video campaigns created with an Ad Group.

Suscríbete a nuestra Newsletter ahora y recibe actualizaciones periódicas de Amazon y otras plataformas de e-commerce.

Suscribirse a la Newsletter ahora.

On the U.S. Amazon marketplace, budget recommendations for new campaigns are now available in the SP Campaign Creation workflow in the Advertising Console. Advertisers will thus receive a budget suggestion from Amazon to maximize their chances of not running their campaign into the “Out Of Budget” tag.

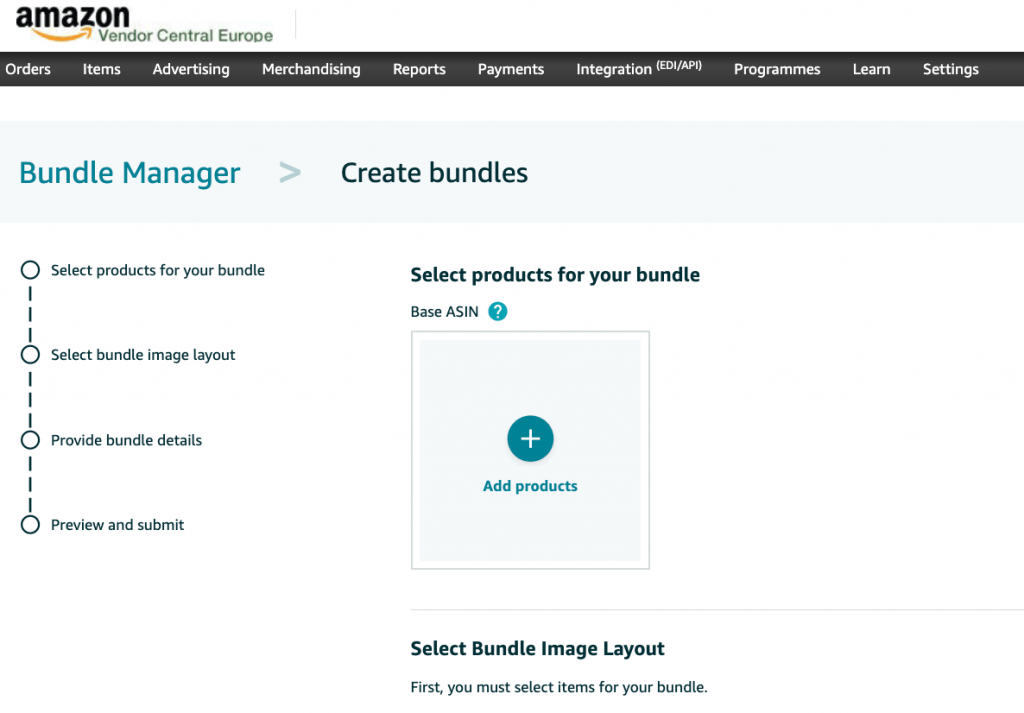

Amazon has introduced a new “Bundle Manager” which can be found under the “Items” tab in the Vendor Catalog. With the Bundle Manager, new bundles can be created quickly and easily without having to do case management. Amazon is also trying to make the creation process of virtual bundles even easier– rumors suggest they will possibly even display sales data for each virtual bundle in the future.

Commentary: Amazon’s Q4 & Full Year 2022 – as Bad as Expected?

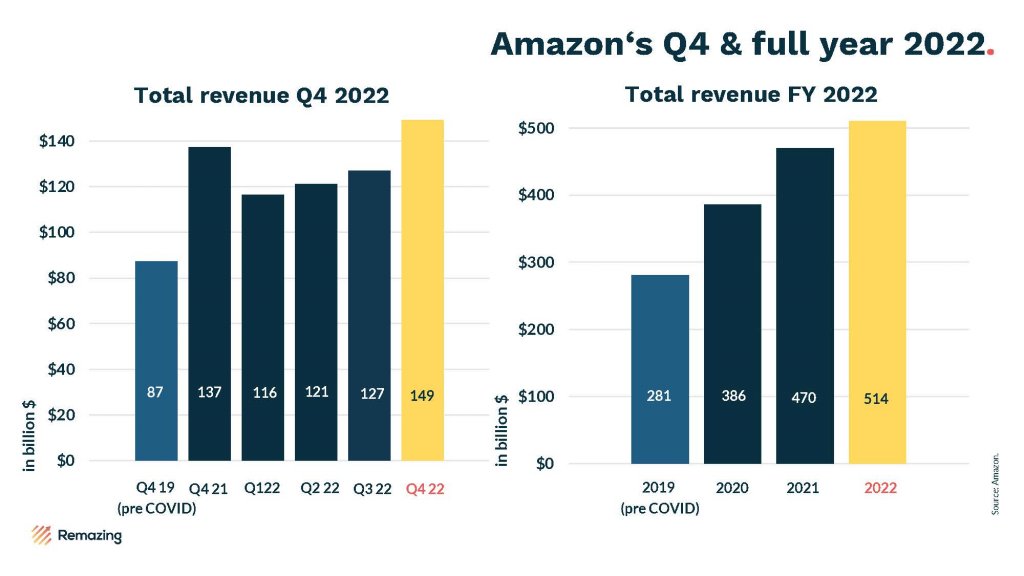

Amazon released its fourth quarter and full-year 2022 results in early February. Although 2022 was not an easy year for global e-commerce, the company still saw growth.

Here are the key sales figures:

- Amazon’s net revenue grew 9% YoY to $149.2 billion in Q4 2022. This growth was mainly driven by the advertising business (+19% YoY) and the e-commerce business in the US (+13% YoY).

- International revenues declined even more than in previous quarters (-8% YoY), mainly due to core European markets, which have been hit hard by inflation and the energy crisis.

- Amazon’s full-year 2022 sales grew by 9% YoY to $514 billion – also mainly driven by sales in the US (+13% YoY) compared to weaker international sales (-8% YoY).

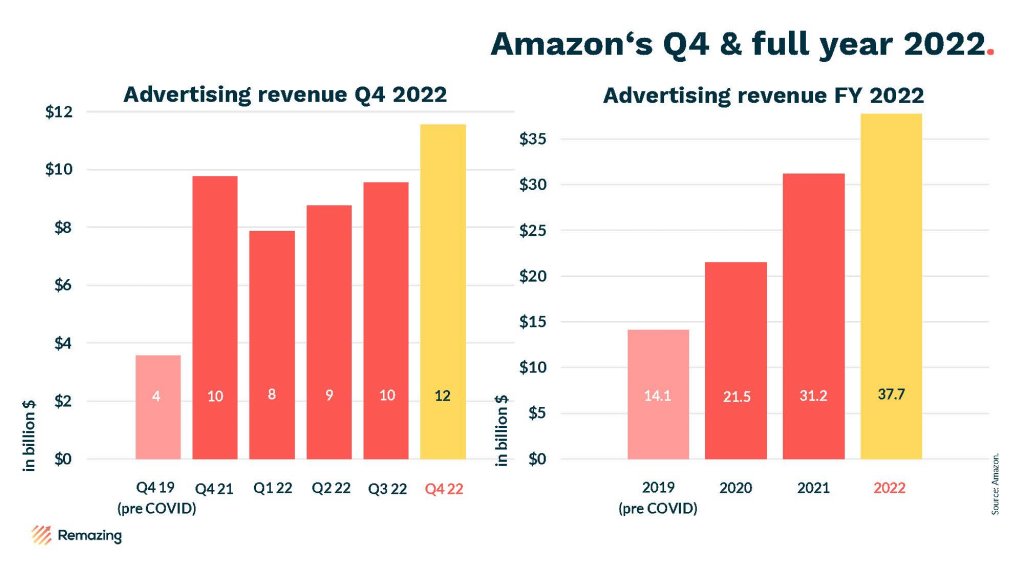

Amazon’s advertising business grew 19% YoY to $11.6 billion in Q4 2022 and 20% YoY to $37.7 billion for the full year 2022. Our estimate of $38 billion in advertising revenues in 2022 at the beginning of the year was pretty spot on! The company has invested in many new advertising features to be able to market more ad space, thus increasing profitability. Our estimate for Amazon’s ad revenue in 2023 is around $45 billion – we expect steady, albeit a bit slower growth.

Amazon Advertising already generates more than a third of the revenues of Meta! The major players in the advertising business suffered a year-on-year decline in Q4: Alphabet (Google): -3.5% YoY & Meta (Facebook): -4.2%.

With these figures, the company exceeded experts’ expectations for Q4 – but the shares still fell by almost 5% due to the rather defensive outlook for Q1 2023. Additionally, Amazon’s operating income declined significantly last year, falling 50% to $12.2 billion in full-year 2022. All in all, after the “Covid Boost,” Amazon is now at the point where an optimistic forecast from three to four years ago would have anticipated sales to be today.

Fact of the Week

In all the markets we surveyed, more Amazon shoppers search for generic keywords than for those of specific brands. The leader, with 69% of respondents searching for generic keywords, is France. Good SEO optimization is therefore also important for brand manufacturers on Amazon (source: Amazon Shopper Report 2022, Remazing & Appinio).

Remdash: Automated Content Protection

Remdash’s Automated Content Protection allows you to protect all product content from unauthorized changes with just a few clicks. Arbitrary content changes are a regular occurrence at Amazon and result in lost revenue if not corrected immediately.

- Monitor all your images and PDP content

- Get alerted if your product content changes

- Fix inaccurate content with just a few clicks

Interested in Remdash?

Just click here to schedule a personal product demo with our team.

Top 5 Amazon Keywords

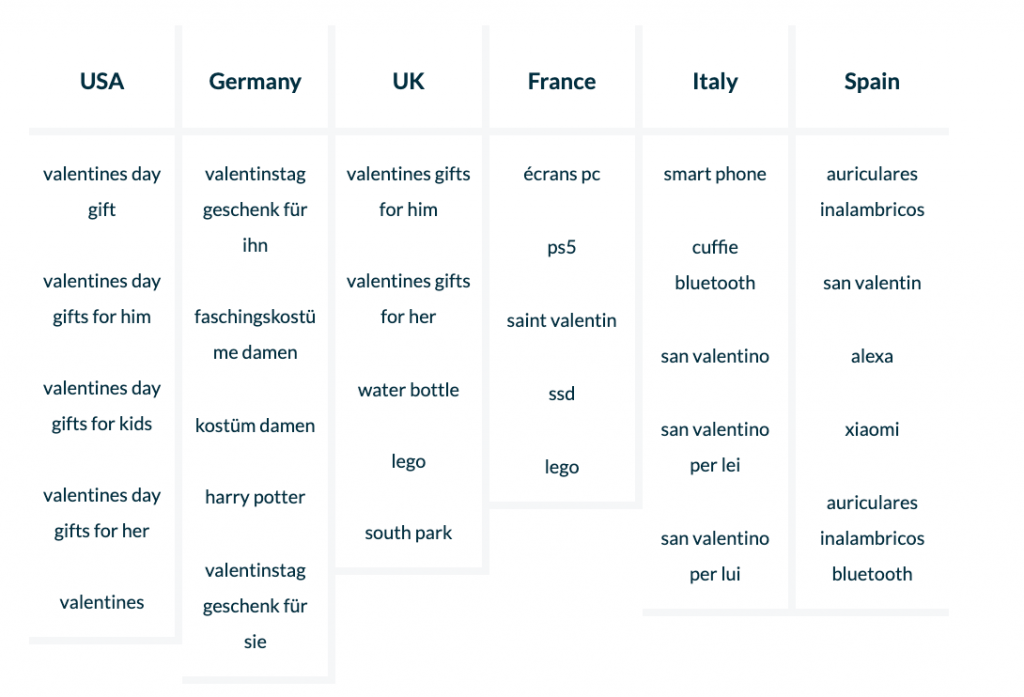

These are the top 5 most searched keywords by country from February 05 – 11, 2023.

February 14th was Valentine’s Day, and shoppers in all markets seem to have been searching on Amazon for a suitable gift for their loved ones. The holiday is particularly present in the US-American marketplace, where all top five most searched keywords were related to the holiday of love.

¿Estás interesado en un análisis experto de tu cuenta en Amazon?

Solicitar análisis gratuito

Artículos relacionados

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH