Amazon’s “Just Walk Out” Technology & “Walmart Health”

Recently published numbers indicate that, despite inflation and supply chain issues, the e-commerce industry excelled in 2022. Sales generated through mobile purchases and via social media saw significant increase in growth.

Walmart seems to be seeing growth potential in the healthcare sector, as the company has announced plans to open more “Walmart Health” centers. With this move, it follows Amazon, who is also increasingly investing into the healthcare sector. Amazon has also garnered attention in recent weeks with its announcement that it will further scale back its cooperation with UPS in order to focus on expanding its own logistics network. The group also said it would close more “Amazon Go” stores in the U.S. and integrate its “Just Walk Out” technology on university campuses through a collaboration with Transact.

Remdash in the News

What Companies Need to Be Successful on Amazon in the Digital World.

Published by Ecommerce Germany, March 13, 2023

Updates: Amazon

Amazon And UPS Are Reducing Their Collaboration

Amazon announced recently that it will be turning away from UPS and other carriers in order to expand its own logistics empire. At the same time, UPS plans to further reduce its business with Amazon, citing the fact that revenue tied to Amazon fell from 13.3% in 2020 to 11.3% in 2022 as justification. The delivery service has begun to focus on more profitable segments such as healthcare companies and smaller shippers.

“Just Walk Out” technology: Closures And New Collaboration

In the U.S., Amazon plans to close eight of its “Amazon Go” stores with “Just Walk Out” technology by April. However, the concept is to be continued: The group recently announced its collaboration with Transact, a mobile payment solutions provider, through whose technology cashier-less payments are now being integrated into stores on college campuses.

Updates: E-Commerce

USA: E-Commerce Grew Strongly in 2022

Despite inflation and supply chain issues, 2022 was a strong year for U.S. e-commerce, with sales exceeding $1 trillion for the first time. Sales from mobile device purchases grew 26.3% in Q4 2022 compared to 2021 and accounted for 38.4% of online retail sales. Revenue from online commerce generated through social media was $53.1 million, accounting for 5.1% of all online revenue.

Following Amazon, Walmart Increases Investments into Healthcare

Walmart announced plans to open 28 more “Walmart Health” centers next year in the United States. The new facilities are expected to offer a wide range of health services such as labs, EKGs, and hearing aids. With this move, Walmart is following its competitor Amazon into the healthcare market. Amazon has been trying to gain a foothold in the healthcare sector for some time; for example, the group recently acquired the American online healthcare service One Medical.

What Caught Our Attention

Amazon currently offers a pilot program called “Call-Off Stock (COS)” that allows merchants in the EU to sell in other EU markets without having to register for tax in the respective country. Amazon stores the merchants’ goods in the respective EU countries, but makes the purchase at the moment of sale, becoming the seller itself. The program is currently free of charge, but merchants must meet some requirements. They, for example, need active accounts on the respective EU marketplaces and must use Amazon’s billing and tax service.

Amazon seems to be planning a new deal event, the “EU Coupon Party,” for March 20-26, 2023. Amazon will supposedly display products on a special coupon page. In order to be listed there, coupons have to be created on the products in advance.

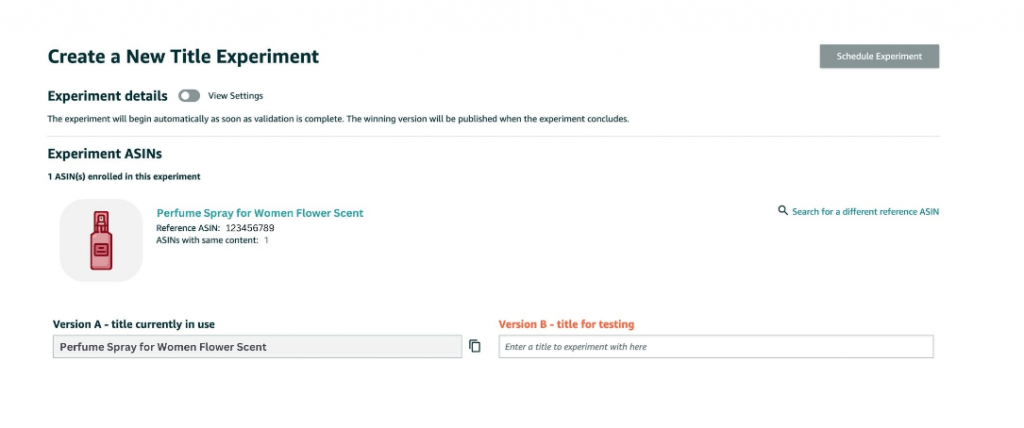

A/B Testing is now available on Amazon for individual ASINs, regardless of their variation. By testing selected ASINs, it might now be possible to get more detailed results.

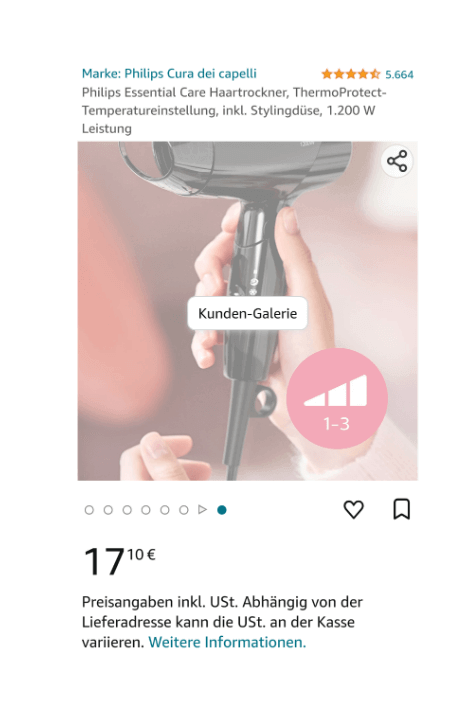

Amazon is currently testing a new feature for the product detail page: the customer gallery. Here, an image from the gallery is repeated after the video, which links directly to the rating images with a button placed above it. However, we have only discovered this feature on the German Amazon marketplace so far and it is only available in the mobile view.

Suscríbete a nuestra Newsletter ahora y recibe actualizaciones periódicas de Amazon y otras plataformas de e-commerce.

Suscribirse a la Newsletter ahora.

Commentary: Retail Media vs. Online Marketplaces

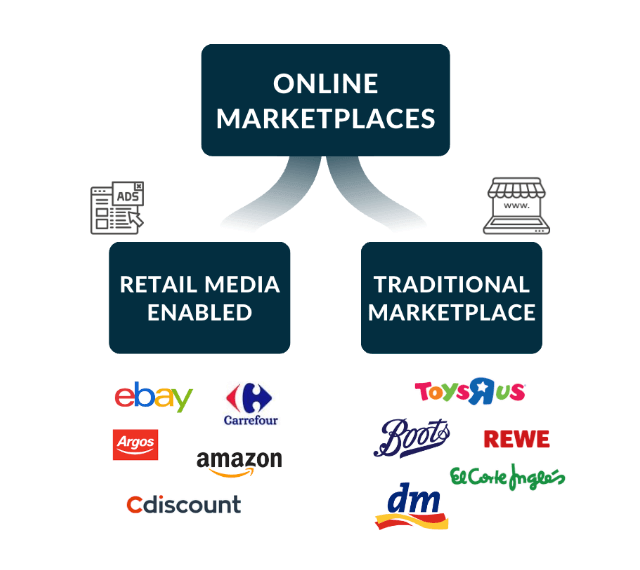

With her statement: “The field of retail media networks is a bit like the ‘Wild West’. There is little to no standardized technology,” Kelly Leger, Managing Director at Deloitte Digital, sums up well a phenomenon that we have also been noticing for some time.

Retail media seem to be enormously successful, and experts predict: 2023 will be the decisive “make-or-break” year for retail media in the US and Europe. But what exactly are retail media networks, how can their seemingly sudden appearance be explained, and how do they differ from conventional online marketplaces?

Definitions: “Retail Media” and “Online Marketplace” are terms that are often, but incorrectly, used synonymously.

- Online marketplaces are websites where products or services are offered by third parties.

- Retail Media Networks are e-commerce ecosystems that aim to reach potential customers through advertising on the platform right next to the offers.

The benefits of retail media networks: One of the main reasons for online marketplaces to integrate retail media into their platforms is certainly the prospect of their profitability. But brands also benefit in a number of ways from the opportunities these platforms offer.

- Sales: Just like conventional online marketplaces, products and services can be sold profitably outside the company’s own online store.

- Branding: Through their presence on a retail media network, brands can both increase their brand awareness and maintain their brand image. Consumers are more likely to search for products on retail media networks than on Google and other search engines, and platforms such as Amazon offer various opportunities to present the brand identity to these searchers in an appealing way.

- Monitoring: Each retail media network differs in terms of advertising options and the extent of data collection, but they all provide greater visibility into advertising activities.

We firmly believe in the future of retail media networks and that 2023 will be their make year, not their break year. That’s why we’re starting with the first article in our new Retail Media Unlocked blog post series.

Fact of the Week

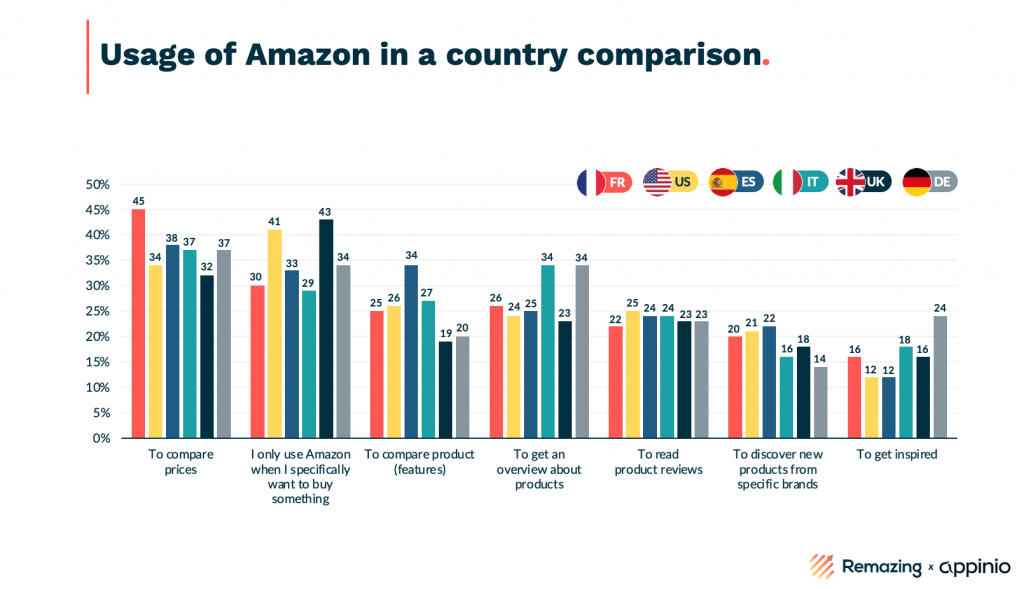

More than 60% of all Amazon customers in the EU5 markets visit the platform without having any specific intention to make a purchase. The majority state that they use the site most frequently to compare prices and get an overview of products. Only 35% use the online marketplace exclusively with a concrete purchase intention (source: Amazon Shopper Report 2022, Remazing & Appinio).

Remdash: Reviews & Questions

Tracking Reviews & Questions offers a tremendous opportunity to understand your customers’ needs.

- Track all of your historic and new Reviews & Questions

- Respond to customers’ questions and increase trust in your brand

- Export all data for your internal reporting and use the insights to improve your products

Interested in Remdash?

Just click here to schedule a personal product demo with our team.

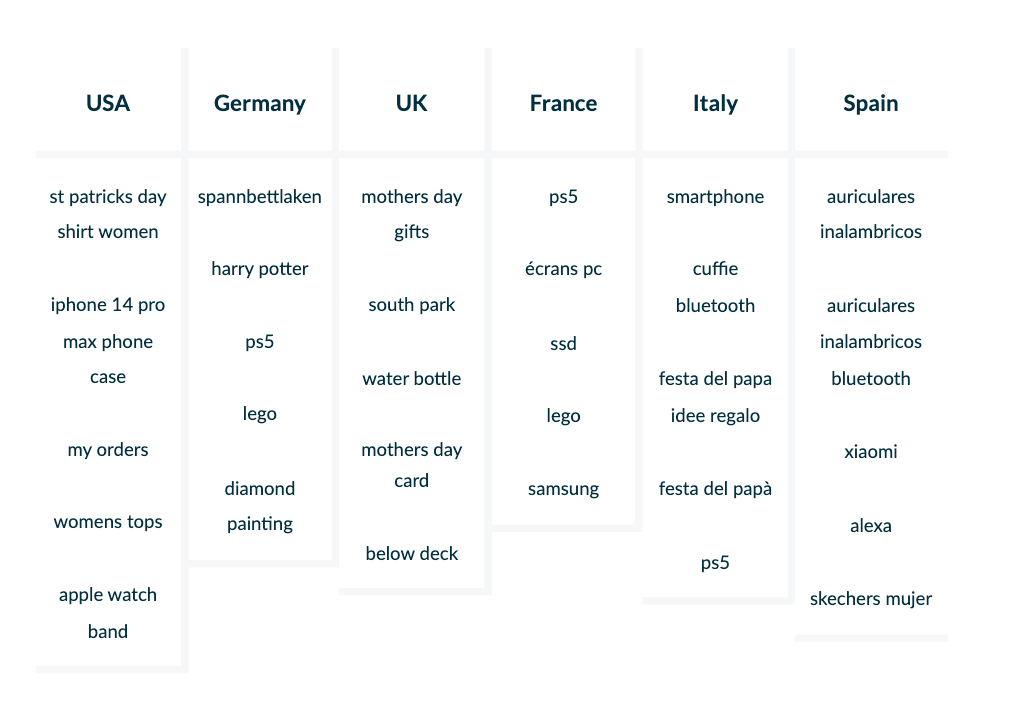

Top 5 Amazon Keywords

These are the top 5 most searched keywords by country from March 5-11, 2023.

While the UK saw an increase in searches for Mother’s Day gifts, Italian Amazon users were on the lookout for Father’s Day gifts. In the US, shoppers are preparing for St. Patrick’s Day and are increasingly looking for T-shirts for women.

¿Estás interesado en un análisis experto de tu cuenta en Amazon?

Solicitar análisis gratuito

Artículos relacionados

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH