Amazon Pharmacy: The German Market Entry Is Just a Matter of Time

Since Amazon was founded in 1995, the company has consistently pursued its strategy of expansion into new markets and business segments. In this regard, the launch of Amazon Pharmacy in the US in mid-November was only the logical next step in conquering the global healthcare market, which already became more tangible through the acquisition of PillPack (purchase price: 753 million US dollars) two years ago.

According to its ‘working backwards’ approach, the team responsible for Amazon Pharmacy published an internal, forward-looking ‘fake press release’ announcing the launch six years ago. The meaningful title at the time: “A Pharmacy in Your Mailbox”.

From cough syrup to prescription drugs

OTC products such as pills against headaches or cough syrup could already be ordered by Amazon customers in the US under its own “Basic Care” label since mid-2017. With success: for example, almost 20,000 positive reviews on Amazon.com for a standard pack of ibuprofen with the Amazon logo on it speak a clear language, not to mention the ‘bestseller’ label.

The big leap announced in November 2020, however, represents yet another significant development for Amazon. With the addition of prescription drugs to its e-commerce platform, customers can now order pharmaceutical products that were otherwise only available at large chains such as Walgreens or CVS with a prescription by a doctor. Unsurprisingly, the share prices of these competitors fell sharply on the day of the official launch of Amazon’s own mail-order pharmacy.

In the US, telemedicine has not only been boosted by the Corona pandemic, but many people now actually prefer to buy their medicines from home rather than in brick-and-mortar stores. In the future, doctors will even be able to send drug prescriptions for their patients directly to Amazon, triggering the ordering and delivery process.

All this, combined with Amazon’s usual price advantages, will make it easy for many existing customers in particular, but also for new customers, to use Amazon Pharmacy. Prime members will especially benefit, even if they have to wait up to two days for their delivery. But even U.S. customers who don’t use Prime can expect big savings through Amazon’s strategic partnerships with health insurers and lower additional charges.

Germany will very likely follow

Even though there are considerable differences between the healthcare systems in the US and Germany, it is only a matter of time before Amazon rolls out its pharmacy in Germany, adapted to the relevant regulations. As the largest market for Amazon in Europe, Germany is certainly high on the company’s list of priorities.

With a large customer base and big amounts of customer insights and data, Amazon can build directly on its success with other product categories. In this regard, an increase in the use of digital health services and in online shopping as a whole can also be seen in Germany. According to a recent survey by mobile market research institute Appinio, online pharmacies in particular are seeing a growth in popularity.

With regard to OTC products, 62% of the survey’s respondents said they would use Amazon for their purchases. The planned introduction of the so-called ‘e-prescription’ is likely to further strengthen this trend in the future, also with regard to prescription drugs. In fact, 49% of the survey participants would already order these drugs via Amazon today.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

Local market players should be ready

Just like in the US, the launch of Amazon Pharmacy would also put considerable pressure on existing market leaders in Germany. Amazon’s strength is its consistent focus on customer satisfaction (‘customer obsession’). It remains to be seen whether German (online) pharmacies can keep up in terms of customer experience and local wholesalers can make their internal processes more efficient, which would ultimately benefit patients and buyers of OTC products.

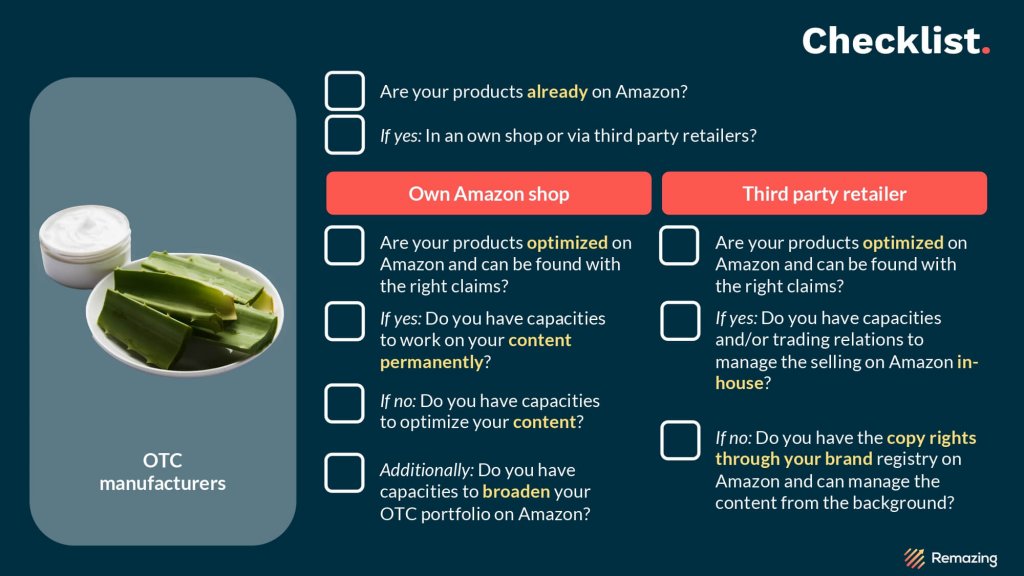

Market players with direct customer access may be able to respond more quickly to the changing requirements and provide a better customer experience, while manufacturers of pharmaceutical products face the challenge of completely rethinking their existing value chain. For the latter, it would be conceivable, for example, to leverage sales opportunities via Amazon and establish a promising direct-to-consumer channel without intermediaries.

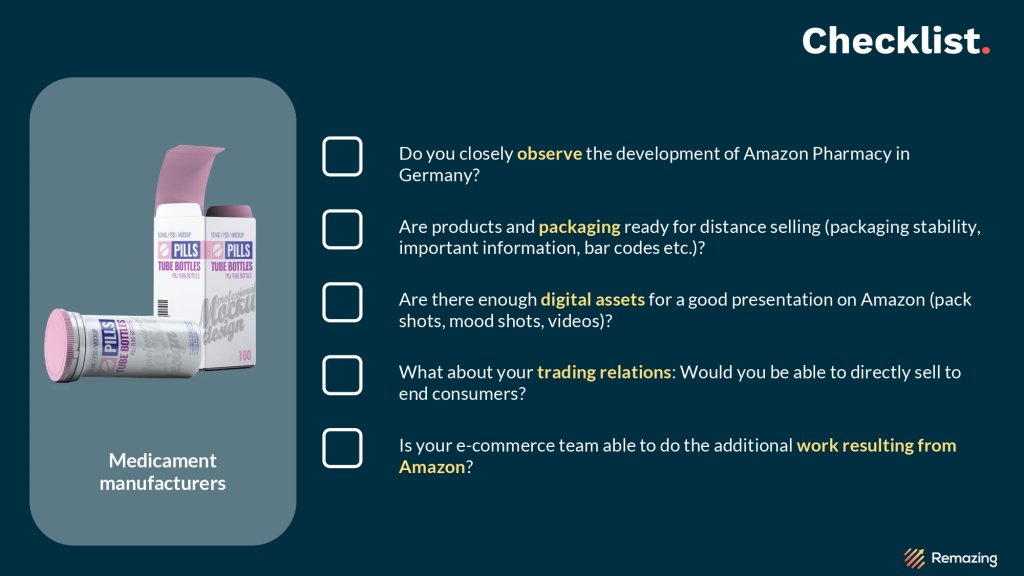

One thing is clear in any case: If the opportunity to enter the German market for online pharmacies arises, Amazon will undoubtedly take this step. Existing participants in the market, from manufacturers to intermediaries to online and offline pharmacies, should already be preparing for this scenario.

As always, when a market evolves in such a way, there are not only risks but also opportunities. In the case of Amazon Pharmacy, the opportunity for manufacturers of OTC products and prescription drugs is to leverage the strength of the Seattle-based e-commerce giant to their own advantage, creating another effective distribution channel.

Many non-prescription healthcare products can be easily offered on Amazon, which is why we are convinced that some manufacturers could take advantage of this opportunity already today.

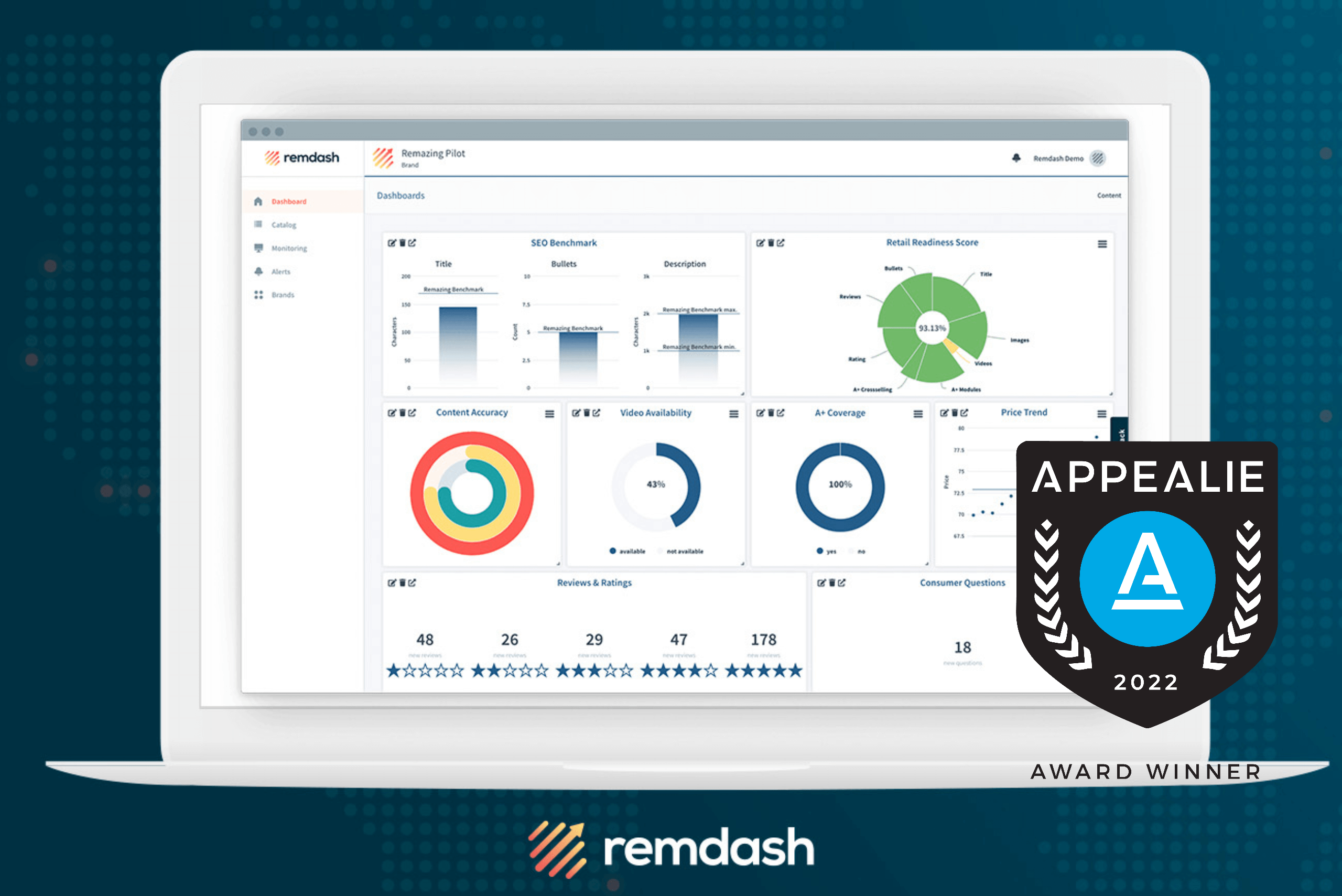

We are definitely following the developments around Amazon Pharmacy very closely for our customers.

This article was first published at W&V.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH