Prime Day 2022 expectations & new Amazon insights

This week it’s that time of the year again: Amazon’s Prime Day will beckon online shoppers with discounts. In the update section of this week’s newsletter, we explain why bargain hunting might be more difficult than usual for customers this year.

In the US, the e-commerce giant is now offering “store analytics” for its brick-and-mortar business, creating a stronger link between its online and offline activities. Meanwhile, in the UK, Amazon is working on its logistics and testing parcel delivery using electric cargo bikes and cars.

P.S.: Once a month, Remazing CEO Hannes Detjen shares his take on the most important Amazon updates of the past weeks in his LinkedIn newsletter. A few days ago, the latest edition for June was published – have a read!

Updates: Amazon

Prime Day 2022: What to expect?

Is Prime Day losing its hype? Some media outlets emphasize that Amazon no longer invests as much in preparing for the sales event as it used to, and likewise that the group’s overall growth has slowed down. While Prime Day sales have increased by up to 65% year-over-year in the past, this year it is expected to be “only” 17% (reaching a total of $7.8 billion). Further, due to increased costs and rising inflation, many retailers may only offer lower discounts this year than in previous years. Others, however, will likely use the deal event to sell off their pent-up inventory with deep price reductions.

Performance insights from brick-and-mortar stores

Amazon has announced a new analytics service for its “Amazon Go” and “Amazon Fresh” stores in the US. According to the company, brand owners can access anonymized data on the ranking and performance of their products, as well as the performance of in-store campaigns, such as digital ads. The service that is called “store analytics” will also be used to improve the overall customer shopping experience. However, there will be an option for customers to object to the data collection.

Amazon dominates German e-commerce market

According to a recent study, Amazon generated a total of 56% of German e-commerce sales in 2021. Of this, 56% was generated by marketplace sellers and 44% by vendors on the platform. OTTO, the second biggest German online store by revenue, is trailing behind Amazon by more than 200%.

London: Parcel delivery by e-bike

With the help of a new “Micromobility Hub” in the London borough of Hackney, Amazon wants to deliver one million parcels per year by e-bike, e-car and even on foot. As a side note: In the aforementioned area, only e-vans and e-bikes are exempt from the local environmental tax. Amazon plans to open more of these logistics centers in the UK later this year. However, the trend toward two-wheelers is shifting congestion and parking problems from the streets to the sidewalks, as some media are already critically noting.

Updates: E-Commerce

Zalando expects worse 2022 financial year

Fashion marketplace Zalando has downgraded its revenue forecast for fiscal 2022 after macroeconomic conditions worsened in the second quarter and the EU consumer confidence index score fell further in June. Instead of growth of up to 19%, Zalando now assumes a maximum increase of 3%. The reason for this is that the current global challenges have lasted longer and are more intense than initially assumed.

TikTok plans to expand its e-commerce activities

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

More e-commerce features are expected to be added to the short video app TikTok in the future. A dedicated shopping segment, which is as present on the user interface as the main content, is currently being tested in Southeast Asia following its launch in the US. In addition, the company is said to be already planning to build warehouses in the UK to shorten product delivery times. However, TikTok has just put the planned roll-out of its live shopping feature in Europe and the US on hold, as the test phase in the UK did not achieve the desired success.

What caught our attention

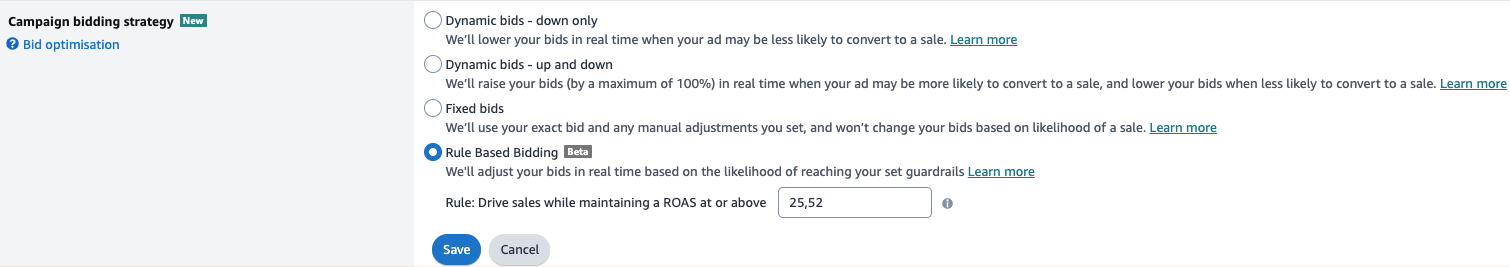

It is now possible to set rule-based bidding strategies and a target ROAS directly in the Amazon Ads console. At the moment, the feature is in its beta testing phase on the US marketplace and is only available for Sponsored Product campaigns that have been running for at least 30 days.

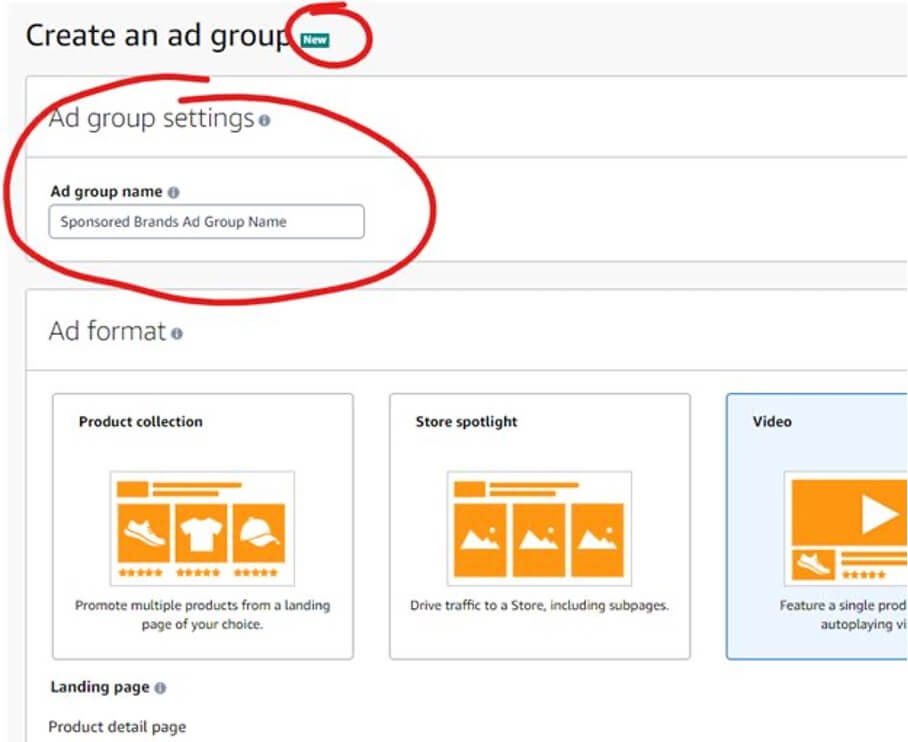

Amazon has also introduced the possibility to create ad groups in Sponsored Brand campaigns – again, initially only on its US marketplace. This feature primarily holds potential for campaign organization.

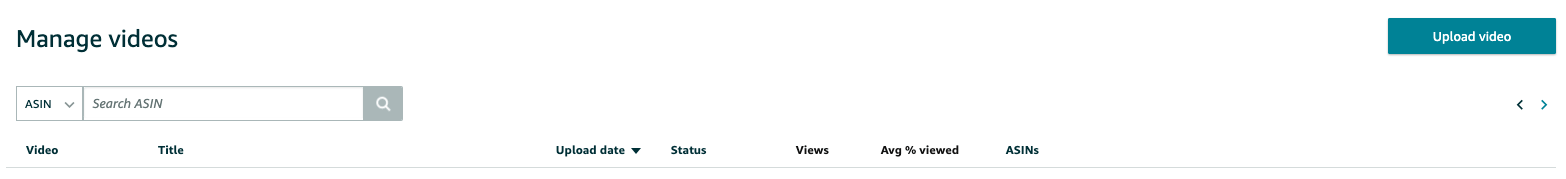

Amazon has also launched a new video tool in Vendor Central. Vendors can upload videos for up to 1,500 ASINs at once and get insights into the performance of their own videos.

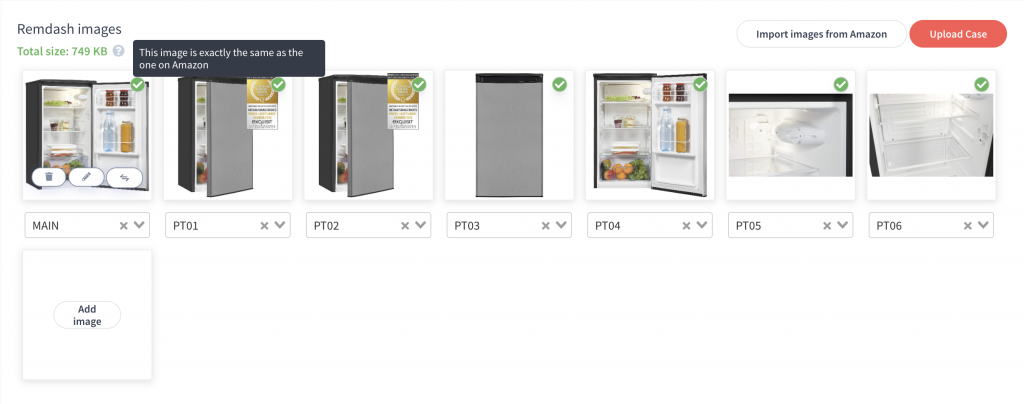

Remdash: Image Case Upload

With Remdash, cases for product images can now be uploaded automatically. The benefits for brands include:

- Automated daily comparison of target images with the actual product images

- Detailed display of the differences in case of unwanted deviations

- Easy upload of the desired images as cases with just a few clicks

- Continuous monitoring of cases

Interested in Remdash?

Just click here to schedule a personal product demo with our team.

Top 5 Amazon Keywords

Online shoppers continue to feel the summer vibe: In the United States, Italy, and Spain, Amazon users were mainly looking for summer clothing and fans. British shoppers mainly stocked up on accessories for the Queen’s Platinum Jubilee, while in Germany gifts for Father’s Day, and in France for Mother’s Day were in high demand on Amazon.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH