Prime Day Analysis 2023

According to Amazon, Prime Day 2023 was the most successful Prime Day ever. So it’s all the more important to take a closer look at the figures and assess what impact this event has had on sales, traffic and advertising.

We analyzed Amazon Prime Day 2023 using our software tool Remdash. The analysis is based on almost 200,000 products of all categories in the European core markets (Germany, UK, France, Italy, and Spain).

The reference for all figures mentioned is a “typical day on Amazon” in June 2023. From the KPIs of the individual days in June, we have formed the average value in each case, to which we refer in the analysis – unless otherwise noted.

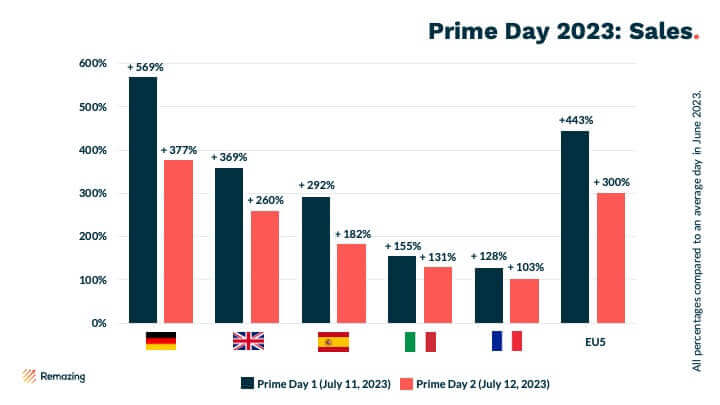

Sales Development on Prime Day 2023

Together with the start of Prime Day on 11.07,, sales increased by 443% on this day (Prime Day 1/PD1) on the EU5 marketplaces. On the second day of Prime Day (PD2), 12.07, sales were still 300% higher than an average June day. The first deal day was thus significantly stronger than the second – this pattern can be seen across each of the Amazon marketplaces studied.

Prime Day performance was strongest on the first deal day on the Amazon marketplaces in Germany (+586%) and the UK (+360%).

In the seven days following Prime Day, sales on the EU5 marketplaces fell to an average level 6% lower than average for June. It is clear that shoppers have made full use of the bargains on offer during Prime Day and as a consequence buy less afterwards. This effect is most noticeable on the French Amazon marketplace with a 10% drop off post-Prime.

Traffic uplift on Prime Day

Based on the sessions analyzed, it is evident that there is overall more traffic on Amazon and the individual product detail pages on Prime Day. Browsing sessions increased by 163% on PD1 in the EU5, and by 84% on PD2. For further comparison, the biggest Prime Day users were the Germans: On amazon.de, sessions on PD1 increased by 295%, while on the French marketplace they increased the least, by just 3%.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

Performance of Prime Day Deals

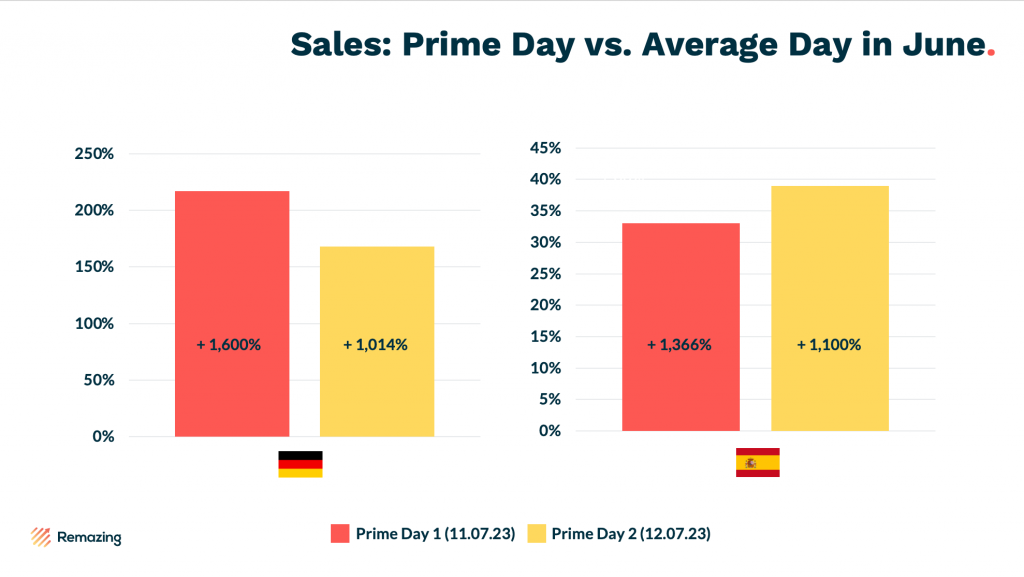

Products featuring Prime Day-specific deals saw sales increase by 1291% on PD1 and 889% on PD2. In comparison, products without these deals underperformed compared to the overall average revenue increase by +130% (PD1) and +90% (PD2).

In a country comparison of Prime Day Deals, Germany recorded the strongest increase in sales with 1600% in PD1 and 1041% in PD2. Spain was in second place with a sales increase of 1366% in PD1 and 1100% in PD2.

Amazon Advertising on Prime Day 2023

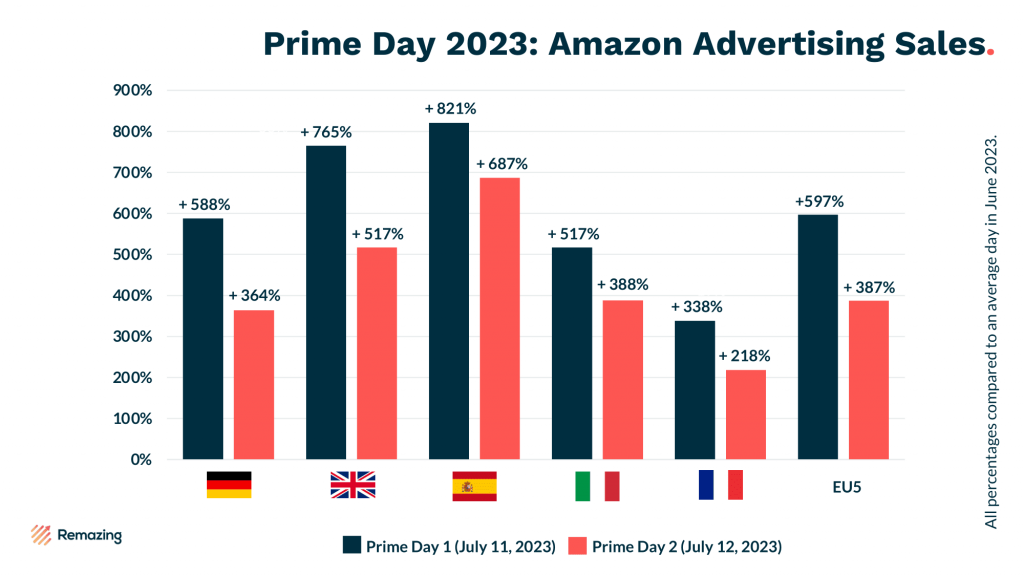

The first deal day was also more successful in terms of advertising KPIs on all the Amazon marketplaces we examined. More impressions, more clicks, more conversions and, above all, more ad sales (+597%* on PD1 vs. + 387%* on PD2) were generated. Ad spend was also significantly higher on the first day (+522%* vs. +467%*) indicating the increased traffic and the resulting increased advertising pressure on the platform.

The Spanish Amazon marketplace recorded the highest ad sales increase on PD1 with +821%. On the same day, the increase in ad spend was +645%. This is followed – also in each case with the highest revenue jump on the first deal day – by Amazon.co.uk with an average of +765% ad sales, the German one with 585 % ad sales and the Italian one with +517% ad sales. The French Amazon marketplace saw the smallest increase in sales in comparison: Here, there were “only” 338% more ad sales on average for PD1.

The average cost-per-click (CPC) on the EU5 marketplaces rose up to €0.77 during Prime Day – an increase of 72%. This price increase took place on PD2; on PD1, the CPC was €0.71, 60% higher than the average June day. The CPC increased the most on PD2 on the Spanish Amazon marketplace with +120%.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH