Which marketplace grew the most in Q2?

In the past two weeks, there have been many updates by Amazon that primarily affect Sellers on the platform: New ways to sell returns, automated approval of returns, and changed fees for Amazon Vine.

Moreover, Amazon plans to introduce ‘Regulatory Advertising Fees’ that will come into effect in September 2021. In our new blog post, we take an in-depth look at this new advertising fee and explain the details you need to be aware of.

In addition, all major online marketplaces have now published their Q2 2021 results. We have compared the growth rate and the revenue of the platforms with each other – read more in Hannes Detjen’s comment further down.

Updates: Amazon

New alternatives for FBA sellers to avoid destroying returns

Amazon is creating new ways for FBA sellers to resell returns and unsold inventory. In doing so, the company aims to reduce the destruction of goods, which so far, unfortunately, has been the most favorable solution for sellers in most cases. Sellers will be able to sell unsold products to remnant retailers via Amazon and offer them via an outlet on Amazon in the future. From 2022 onwards, they will also be able to use Amazon Warehouse to sell returns.

Amazon automates returns for sellers

Starting on August 30, 2021, there will be an automatic approval of return requests for products sold by FBM sellers. Previously, the requests had to be reviewed individually by the sellers. Amazon wants to offer customers an even better shopping experience and save sellers time. However, some sellers are very critical of the new regulation as it will not be possible to check whether a return is in order or not.

Logistic problems at Amazon

FBA sellers are currently facing a major problem by not being able to store enough goods in Amazon’s logistics centers. As it was the case at the beginning of the COVID-19 pandemic last year, warehouses are often full – unsold products are blocking space. As a result, goods that are in high demand are often unavailable. Amazon is therefore increasingly trying to win over sellers for the FBM model. There is even speculation about a second Prime Day in 2021 due to the logistics problems.

Changes in fees for Amazon Vine

Until now, participation in Amazon’s tester program Vine was free for sellers, and vendors had to pay an amount depending on product, category, and number of reviews. Starting on October 12, 2021, each new product registered in the program will cost sellers €170 and vendors €1,350. Amazon states that it wants to ensure the long-term success of the customer review program this way.

Sellers contact authors of negative reviews

As has now become known, some Amazon sellers repeatedly contact their customers via email to get them to delete bad reviews. In many cases, even money is offered to incentivize the authors of bad reviews to do so. According to Amazon guidelines, this is strictly prohibited, contacting sellers per se is not allowed. Why positive reviews are important and how they can be used on Amazon gets explained in one of our recent blog posts.

Amazon pays restitution to aggrieved customers in the US

Starting in the US in September 2021, Amazon will pay up to $1,000 in compensation to customers who have been harmed by a defective product sold by merchants on the platform. Like this, the company wants to reduce the number of lawsuits in which it is repeatedly held responsible for products on its marketplace.

German Shopper Report 2021: Amazon

In a special analysis of its German Shopper Report 2021, e-commerce services provider Pattern took a closer look at Amazon.de. Among the results of the analysis, the following stood out: 57% of survey respondents search on Amazon for products they can’t find in brick-and-mortar stores, 38% compare prices, and 36% simply look for product information. Most appreciate the ease of shopping on Amazon (64%), the variety of products (62%) and fast delivery (58%). Amazon has “become the most important shop window in Germany,” the survey conludes.

Updates: Other marketplaces

E-commerce growth in Q2: Walmart, Ebay, Etsy, Zalando & Mercado Libre

Many major marketplaces have now released their Q2 2021 results. Walmart made 6% more revenue with its US e-commerce division than in the same quarter last year. Second hand platform Ebay grew by 14%, DIY marketplace Etsy generated 23.4% more revenue. While Zalando grew 34%, South American e-commerce platform Mercado Libre doubled its returns by growing 102.6% year-over-year (YOY). By comparison, Amazon‘s YOY growth was 27% in Q2 2021. Considering the very successful Q2 in 2020 that was strongly influenced by the COVID-19 pandemic, the continued revenue growth of all platforms is still very remarkable.

What caught our attention

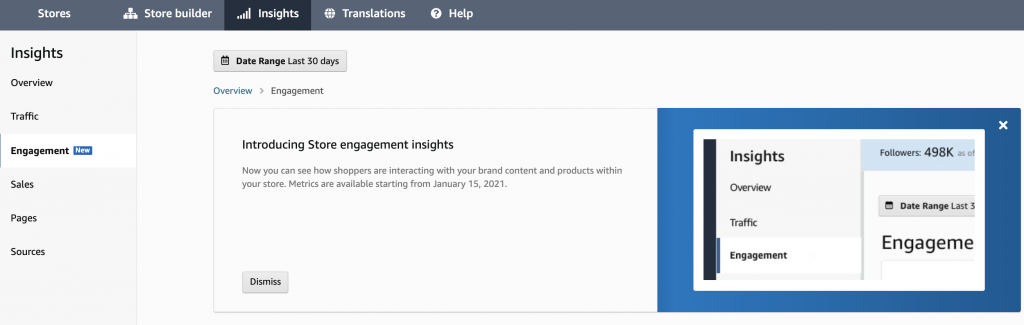

Amazon is testing Store Engagement Insights as a new feature for the Brand Store. The new platform update provides insights into Brand Store performance at the product level, enabling optimization: most viewed and missing products, as well as views, clicks, and CTR of each product are displayed.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

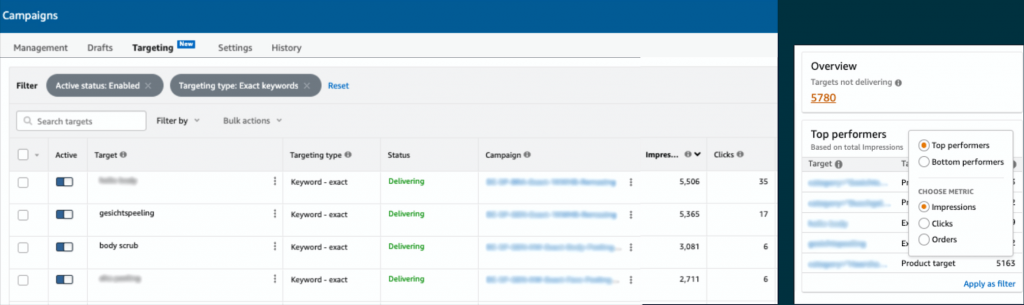

We also discovered a new feature in the Advertising Console: an overview of all used keywords. This makes it easy to adjust bids for each individual keyword. The best performing keywords can also be determined from all campaigns and sorted by impressions, clicks and orders.

The feature was previously only available in a seller account.

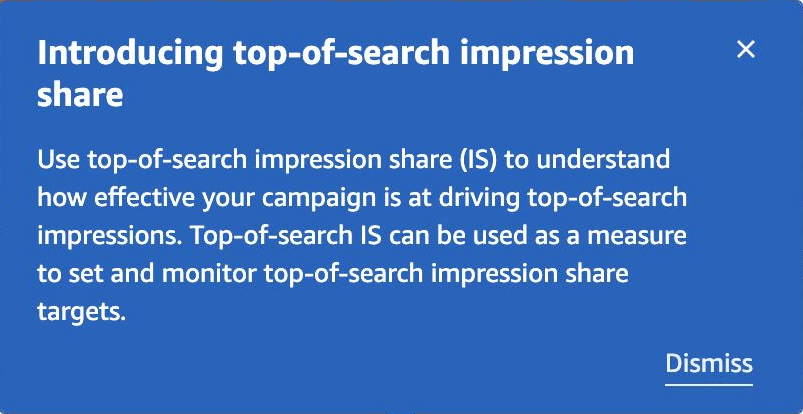

The new Top of Search Impression Share in the Advertising Console helps to understand how successful one’s advertising campaigns are on the top positions of the search results page. It is still unclear which advertising positions are specifically considered “Top of Search”. We are looking forward to a more precise statement by Amazon on this.

Comment: Marketplaces’ Growth in Comparison

It’s again time for a comparison of the growth figures of the largest online marketplaces worldwide. After all, Amazon “only” ranked 4th in Q2 2021! But of course, the e-commerce leader’s results are at a completely different level than the ones of its competition.

Some key take-aways:

Mercado Libre shows the highest quarterly growth, just like in Q1 2021.

Walmart’s numbers are related to its US e-commerce business only. The company’s overall growth was even slower (+2.4%), but the development of its international e-commerce division looks promising with +24%.

Etsy’s growth slowed down a lot in Q2. The effect that can be observed here has to be put into perspective to the very strong results in Q2 2020 when Etsy profited a lot from the reemerging DIY trend related to the COVID-19 pandemic.

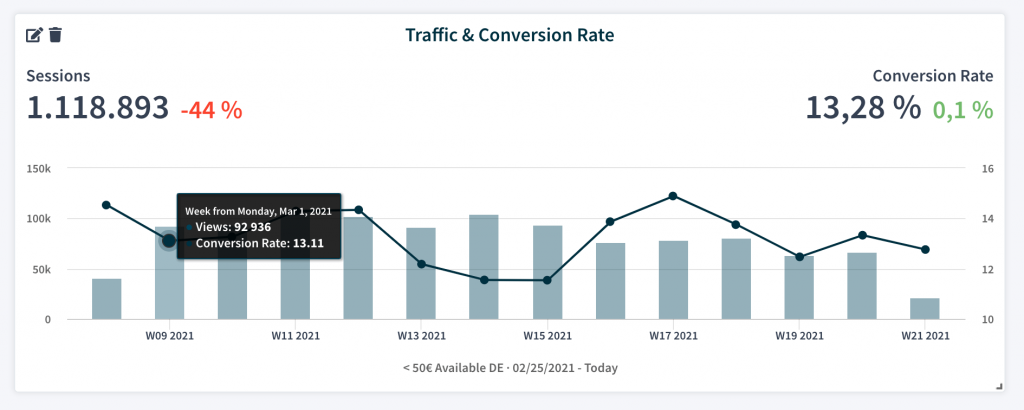

Remdash: Traffic & Conversion Rate

With Remdash, you can analyze your Traffic & Conversion Rate data from both Seller and Vendor Central. Our tool allows you to:

- Compare product groups or single ASINs with each other

- Compare global data and marketplaces data

- Group data daily, weekly, or monthly

- Combine data from Vendor Central and Seller Central

Interested in Remdash? Schedule your personal product demo here!

Top 5 Amazon Keywords

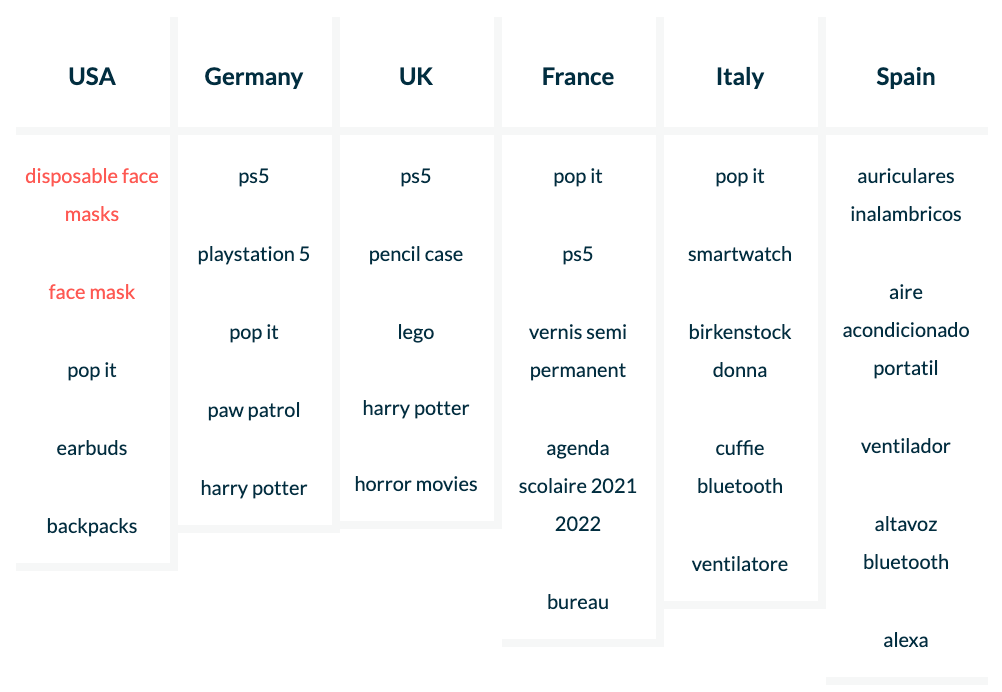

In the US, the local regulations related to wearing masks have become stricter again since the end of July. This is reflected in the Amazon search terms. French Amazon customers are preparing for the nearing start of the new school year after the summer holidays. In Italy and Spain, it looks like there is still lots of summer heat according to the top keywords.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH