Brexit and the New E-commerce Reality for Amazon Retailers

Brexit has been a regulatory minefield for Amazon retailers. Months on from formally exiting the EU, the new trading relationship continues to create logistical challenges, both inside the UK and out.

Overview: Brexit & Amazon

With the UK leaving the EU Single Market and customs union, two new regulatory ecosystems have been created where before there was only one. Now customs compliance and form-filling is required when moving goods between the UK and the EU, placing the burden of regulatory compliance on retailers.

Amazon Vendors and Sellers alike should take steps to meet the requirements of:

- The regulatory zone they are selling into and

- Amazon’s own legislative standards

This latter point in particular is the focus of this article. The new requirements of Amazon have impacted a number of key areas including

- VAT and customs charges

- Product compliance and labelling

- Inventory management

- Paperwork and delays

Key areas where Amazon Business may change through Brexit

Whereas before there were relatively few obstacles to trade between the UK and other EU member states, now there are a number of potential pain points to consider:

1. VAT and customs charges

What is the issue?

Brexit’s impact means there may be additional costs to be borne for staying compliant with these new regulations, such as customs charges or consultancy fees. These new VAT rules will require merchants to reassess their own costs and profitability.

What has changed?

From a taxation point of view, the end of the transition period saw legislation introduced in the UK which resulted in two key developments:

- Sales delivered to EU customers, originating from the UK, will now be considered “exports” and zero rated for UK VAT.

- Amazon (and other e-commerce marketplaces) will now be responsible for collecting and remitting UK VAT on deliveries to the UK where: (i) The value does not exceed £135, and (ii) where the seller is not a UK business.

This is set to be a big problem for companies selling on Amazon B2C. Whilst previously there were VAT exemptions for sales under £15 and products stored in the UK for a seller based outside the market, Amazon will now collect VAT on these sales. Either way, EU-based Amazon sellers looking to continue their activity in the UK can expect to find increasingly fewer strategies to minimise paying UK VAT.

What can you do about it?

In terms of short-term solutions, Amazon has already issued preliminary advice:

For Vendor clients

- Amazon is keen that merchants firstly register for VAT in territories where required (you should consult your tax advisor but can also find information on gov.uk for UK inbound, or your local government website). These VAT registration IDs should also be uploaded to Amazon as soon as possible to ensure Amazon can process invoices from Vendor clients promptly.

For Seller clients

- The process remains similar but Amazon has also offered up its own services for a fee (referred to as “VAT Services on Amazon”) for companies who wish to outsource their VAT handling to Amazon and their list of preferred tax service providers.

Given there are wider challenges associated with VAT related to customs clearance and other market barriers, Amazon recommends both Vendor and Seller clients onboard themselves with a customs broker – an agency or body that can negotiate with respect to customs declarations and cross-border shipping on behalf of sellers.

2. Product compliance and labelling

What is the issue?

The emergence of two separate regulated markets has resulted in a second issue which has meant merchants must now make sure that their stock meets the correct labelling standards and is appropriately regulated for the market in which they want to sell. Whilst the previous labelling requirements are not immediately obsolete, there are new requirements coming shortly to ensure UK compliance.

What has changed?

The pre-Brexit CE marking indicates that a product sold within the European Economic Area meets certain safety, health, and environmental standards. Post-Brexit, the UK has introduced its own UKCA marking. Despite this, many UK businesses still seek the CE marking in order to allow their products to be listed on marketplaces in the EU.

The second challenge for businesses is ensuring that Amazon-listed products are compliant with new protection standards. For UK-based businesses the CE-marked products must now have a listed contact person (“Responsible Person”) and their address within the EU displayed on the label. Until this requirement is fulfilled, and a Responsible Person is appointed for all future product compliance issues, ASINs risk being delisted by Amazon for being non-compliant!

What can you do about it?

For UK businesses wanting to maintain a European market presence in CE-required markets, the need to have a Responsible Person inside the EU looms large. To alleviate concerns regarding this, Amazon has created a Responsible Person Hub which explains the more specific requirements for a Responsible Person, and where they should be registered on Amazon seller platforms. Some options for who can be appointed as a Responsible Person include:

- An EU based subsidiary or EU Importer

- The testing lab or certification company that is used for a seller’s products

- Third Party partners within Amazon’s Seller Network

- Amazon themselves, via their own FBA Responsible Person service

Whilst the UK market begins to establish its own standards and markings, Amazon’s main recommendation is that merchants ‘dual label’ all products to reach as many customers as possible.

In terms of CE branding in the UK: Up until December 31st 2020, products branded with a CE mark are “grandfathered” into UKCA acceptance and won’t require a separate mark. However after that point, UKCA marks will be required for certain product categories in the UK. Amazon therefore advises that product packaging should include both UK and EU labelling and conformity markings where necessary.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

3. Inventory management

What is the issue?

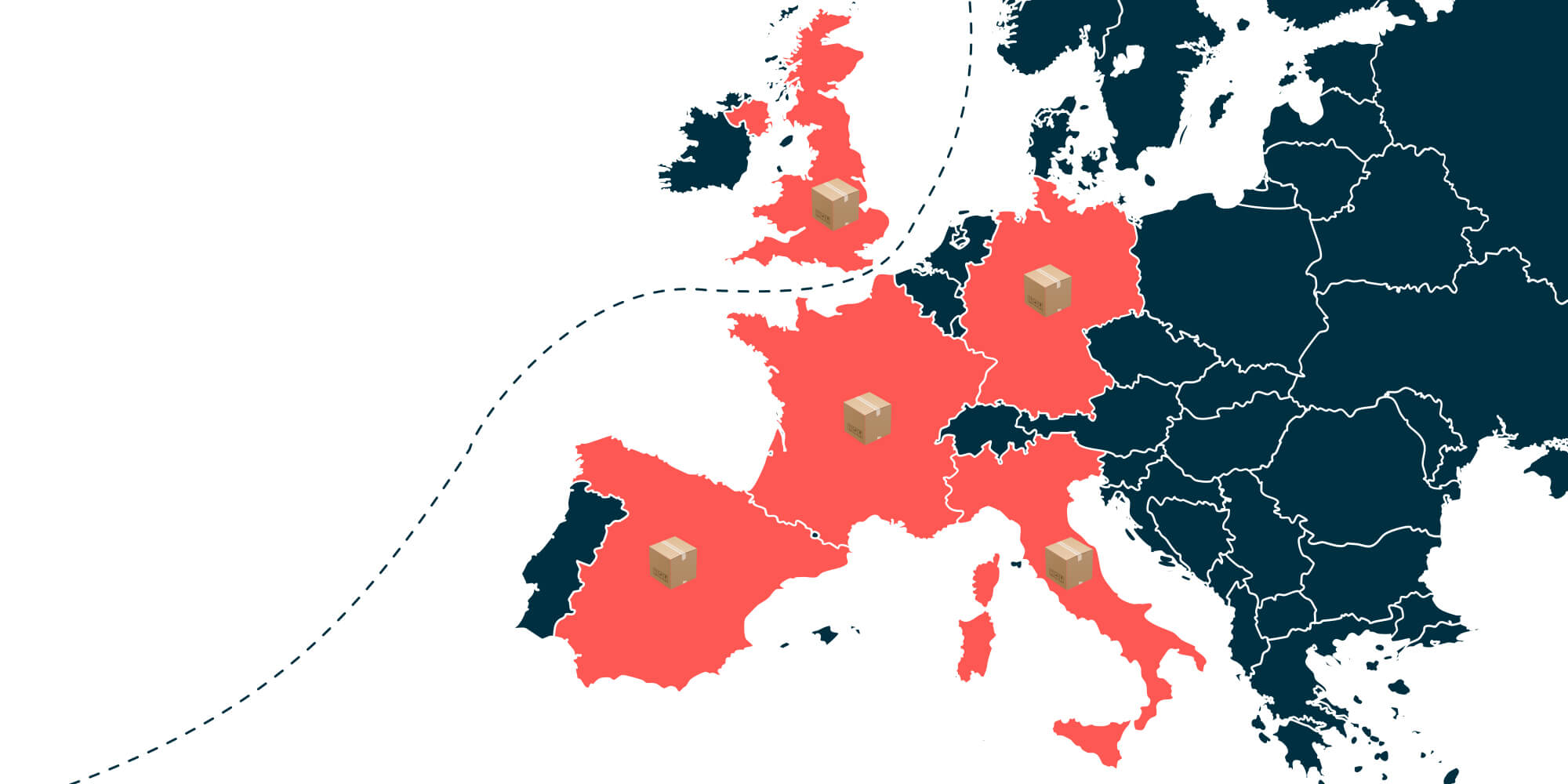

Inventory management systems may need to be reconfigured to deal with Brexit as UK and EU stock is no longer considered mutually interchangeable in many industries. New EU and UK storage limitations pose significant inventory challenges to merchants.

What has changed?

Due to Brexit changing the nature of cross-border shipping, Amazon has ceased its European Fulfilment Network (EFN) and Pan European FBA programme, making it more difficult to sell UK stock in Europe and vice-versa. Accordingly, there are significant logistical and storage limitations for many sellers on Amazon, as storage space in UK warehouses is at a premium. Amazon has significantly reduced its storage capacities leading to sellers encountering enforced sell offs or recalls of excess stock. This is having a significant impact on long-term purchase forecasting for many businesses.

What can you do about it?

For businesses facing the challenge of no longer being able to store EU stock in the UK and vice versa, the proposed solution from Amazon’s Pacific Northwest HQ is to “dual inbound” products. This means stock can be sent to separate fulfilment centres inside the EU and in the UK. For Seller clients, Amazon can even recommend a breakdown of which products to ship to the UK and EU based on future FBA demand.

Sellers and Vendor clients may want to consider a number of factors to ensure a seamless transition to two pools of inventory:

- Country of Origin and HS Code information for each product: Having the correct COO and HS (standardised commodity codes) should ensure that Amazon can maximise the availability of each product and that any appropriate import duties can be paid.

- Checking EORI numbers: It is important to register for EU and UK EORI (Economic Operators Registration and Identification). Numbers as both UK or EU sellers sending shipments to both sides of the border will require a UK and an EU EORI. One EU EORI number will continue to be sufficient for all EU countries.

- Choose how to handle customs declarations – yourself vs. third party: Using a third party is recommended by Amazon, e.g. a customs broker, owing to their vast experience in the changing world of international trade. However the UK Government has also announced a grant for companies that handle customs declarations themselves.

- Identifying an EU-UK compatible carrier: Some carriers have stopped or temporarily suspended their cross-border delivery services, given the adjustments to the UK/EU trade agreements, therefore it is prudent to check that any potential logistics partners will continue to serve across borders. Amazon offers its own carrier programme, the EU Inbound Preferred Carrier Program (IPCP), which is available for selling partners to register their interest if they are struggling to find a logistics carrier.

All of the above is likely to mean additional paperwork and customs checks at borders due to the extra documentation required. These include customs declarations, product compliance documentation and any licenses or permissions required to sell in the desired country. These new customs checks take time and this can mean longer transportation times to get goods from A to B. This is particularly relevant for merchants transporting food or other perishable goods.

Our Recommendations: How to deal with Brexit on Amazon

Engage with Amazon

Although Amazon is infamous for being difficult to contact, engaging with them where possible is important when considering how your business will be impacted by these changes. If this is not possible, the information Amazon has published around these specific topics is extensive and the services they have created, including the EU Inbound Preferred Carrier Program, the Responsible Person Hub, and VAT Services on Amazon, are comprehensive offerings and should be seriously considered.

Keep up-to-date

Whilst e-commerce platforms are doing their best to make information available to retailers, the situation is constantly evolving. In a new and unprecedented trading environment, such as that which has been created by Brexit, best practices are still a work-in-progress and need to be constantly reviewed and adjusted. For larger businesses with in-house regulatory and compliance teams, there will be a requirement to upskill your workforce to get to grips with the changes and continued uncertainty.

Consider investing in an e-commerce consultancy firm

Smaller businesses that do not have the internal capacities to keep up-to-date might want to consider finding external support from a consulting business. Many e-commerce consultancy firms offer expertise in new market expansion, as well as maintaining existing supply chains into and out of the UK post-Brexit. They can likely offer a range of services and expertise as well as contacts to carriers who will ship between the UK and the EU.

Consider a different Amazon strategy

Given the host of challenges around doing business with the UK, we have seen a rise in Vendor clients considering a move towards a hybrid Amazon strategy through opening an additional Seller account. This approach can enable businesses to be more agile in approaching some of the challenges within the UK market, for example within logistics and storage solutions. However, a hybrid approach does have significant implications on businesses’ entire Amazon strategy and therefore whilst beneficial for some businesses, for others it can lead to a host of new challenges.

Reevaluate your UK Amazon strategy

The host of additional considerations for businesses selling on Amazon will require a significant degree of time and financial investment. Aside from costs associated with remaining up-to-date with how the new economic trade landscape will impact your business, there are more specific costs such as Amazon’s new VAT requirements, additional product compliance and labelling demands and incurring costs around logistical and storage, that businesses must now consider. Ultimately, companies must now reevaluate the profitability of their UK and EU operations in light of these changes.

Conclusion: Brexit will continuously impact Amazon business

This guide can only address some of the many challenges posed by Brexit. We have highlighted VAT, product compliance and inventory management as priority areas for Brexit-affected businesses on Amazon, but it should be noted that this is a situation which will continue to evolve. The impact of the Covid-19 pandemic has meant the effects of Brexit are yet to be fully realised by much of the e-commerce world. However an understanding and adherence to the latest compliance standards is the safest bet to continue to use Amazon’s services with minimal disruption. Businesses can do their due diligence themselves, but equally, they should not be afraid to make use of specialist third parties who can advise on the best course of action.

Remazing is a full-service Amazon agency with a wide range of contacts and expertise. If you would like to work with us, please contact us via our website.

Sources:

Amazon: “Preparing your Amazon Business for Brexit: A Practical Guide for Selling Partners”

Amazon: “FAQs on UK/EU trade and your Amazon business”

Global E-commerce Experts: “E-commerce hacks to help re-establish your trade 6 months after Brexit!”

Justine Jenkins: “The impact of Brexit on Ecommerce Businesses: All your FAQs, answered”

UK Government: “Exports, sending goods abroad and charging VAT”

Are you interested in an expert analysis of your Amazon account?

Request free analysisRemazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH