Analysis: Black Friday on Amazon 2022

This year’s Black Friday weekend found itself in a rather ill-starred position. Factors such as supply chain issues, the economical crisis and a stronger competition with reopened physical stores led to pessimistic sales predictions.

But did the deal event really perform as poorly as it was anticipated? We analyzed Black Friday 2022 on Amazon with the help of our tool Remdash. The analysis was based on 20,000 products of all categories on the European core markets (Germany, UK, France, Italy, Spain).

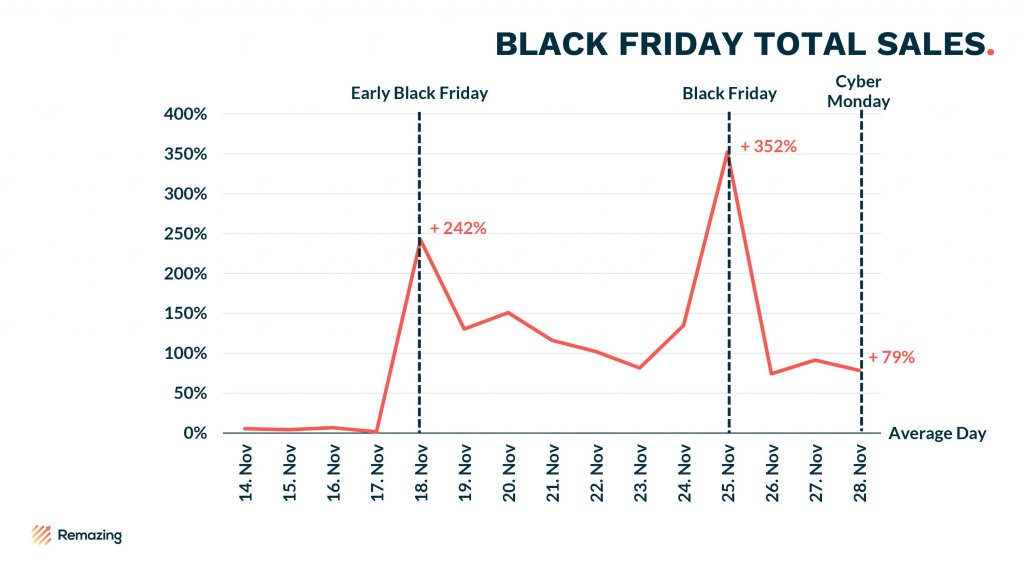

The reference for all figures mentioned is the performance on an average day in CW 44 – 45 (Oct 31 – Nov 13), the two weeks before the Early Black Friday week (CW 46). From the sales of the individual days in this week, we have formed an average value, to which we refer in the following analysis – unless otherwise noted.

Sales Development on Black Friday 2022

To grasp the deal day performance we first looked at the change in sales across all Amazon marketplaces during the Black Friday weeks on a daily and weekly basis.

With the launch of the Early Black Friday Deals on November 18, 2022 the sales increased by 242% on that day. At + 145%, sales for the following entire Black Friday Week (Nov 21 – Nov 27) increased significantly compared to the average for CW 44 + 45. As expected, Black Friday (Nov 25) was the highlight of Black Friday Week, with sales up 352%. Cyber Monday (Nov 28), on the other hand, was a comparatively weak conclusion to the deal event: sales rose by only 79%.

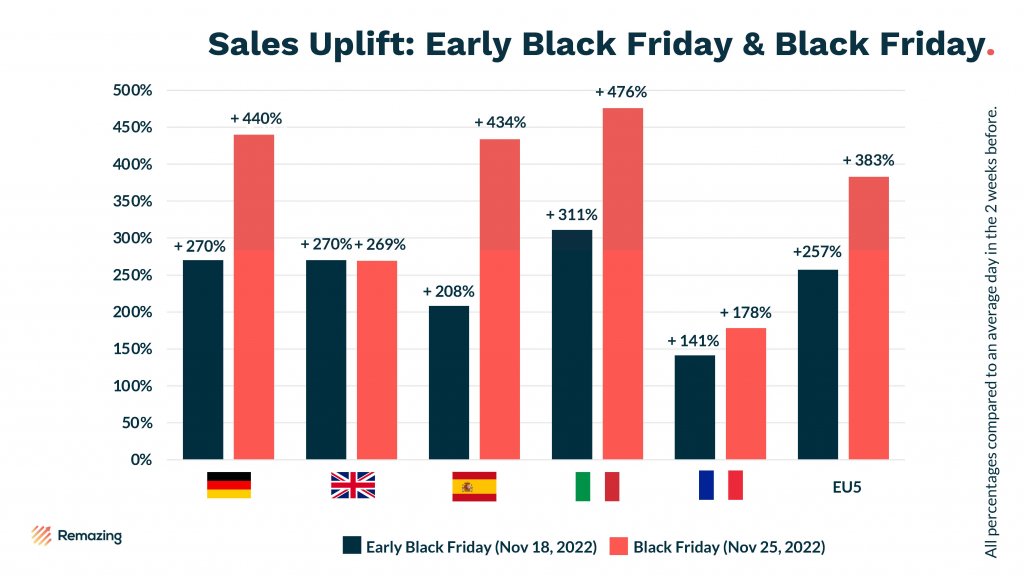

The Black Friday performance was the strongest on the Italian (+ 476%) and German (+ 440%) Amazon marketplaces. What is actually surprising is Spain’s comparably high (+ 434%) and Great Britain’s comparably low (+ 269%) sales uplift.

The Success Catalysts: Early Black Friday & Black Friday

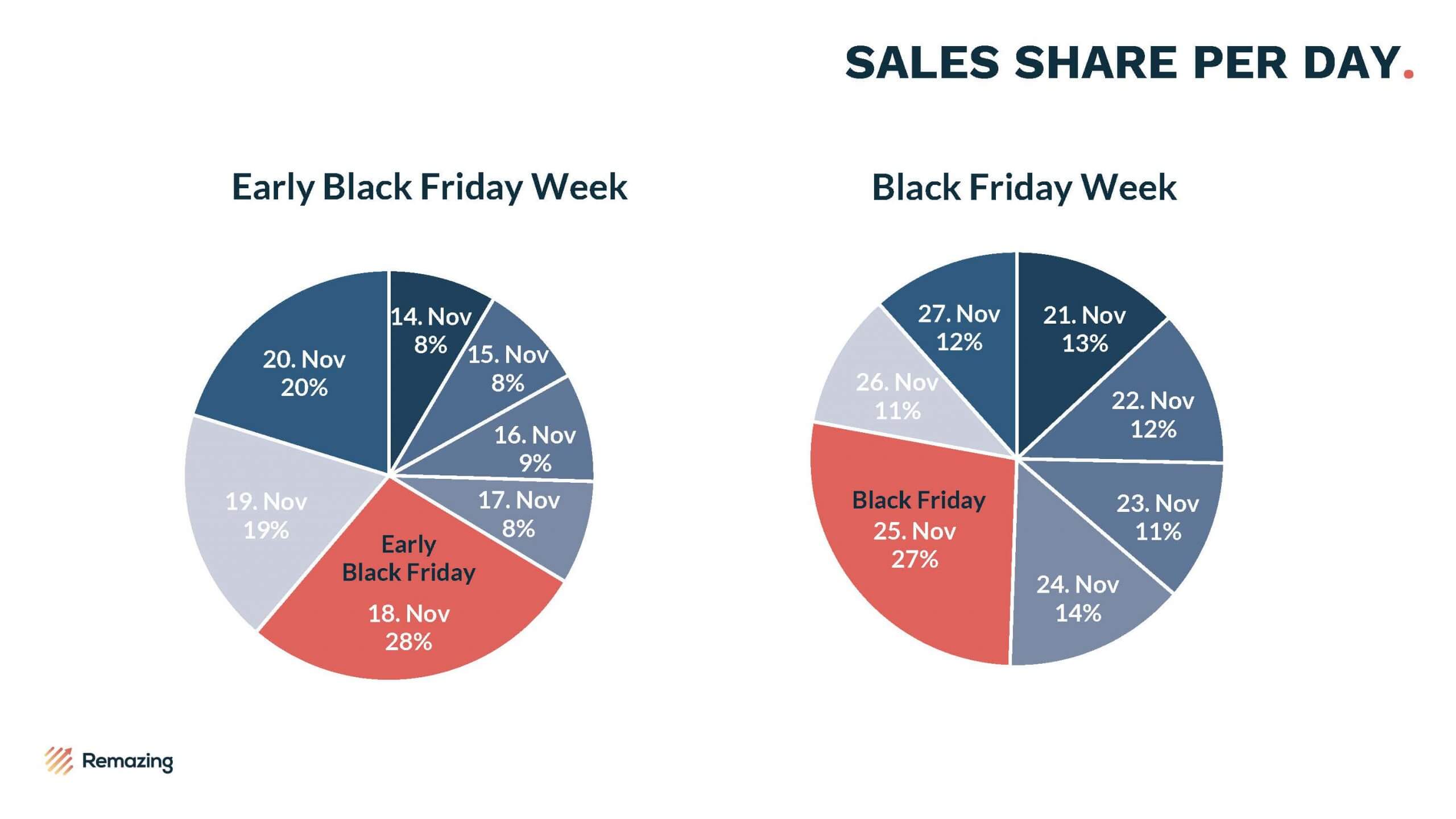

Looking at Black Friday Week, two deal days stand out strongly: Early Black Friday (Nov 18) and Black Friday itself (Nov 25). The two days each accounted for the largest share of weekly sales – nearly a third:

- 28% of weekly sales on Early Black Friday

- 27% of weekly sales on Black Friday

Mainly on Early Black Friday and Black Friday, traffic on the platform was strongly increased:

- + 141% Glance Views on Early Black Friday (vs. + 65% in the entire Early Black Friday Week)

- + 172% Glance Views on Black Friday (vs. + 99% in the entire Black Friday Week)

We saw a slight decrease in conversion rates, especially during Early Black Friday, with a drop of 10% to a conversion rate of 11.6%. The conversion rates declined less drastically during Black Friday and Cyber Monday with -1% to a CR of 12.8% and -3% to a CR of 12.5%. In comparison: last year, the conversion rate rose during the deal days compared to the two previous weeks. This change could be attributed to the increased economic pressure on consumers that are more inclined to find the best deal rather than just any deal.

- Drop of 10% CR on Early Black Friday (vs. – 9% in the entire Early Black Friday Week)

- Drop of 1% CR on Black Friday (vs. – 11% in the entire Black Friday Week)

- Drop of 3% CR on Cyber Monday

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

Amazon Advertising on Black Friday 2022

Advertising generated an 84% increase in revenue in our sample during Early Black Friday Week, and 87% more revenue during Black Friday Week than in CW 44 and 45. Ad Spend was 88% higher than average during Early Black Friday Week, and increased 87% from the average during Black Friday Week. The ACoS rose by 2% in Early Black Friday Week and we saw no increase during the Black Friday Week.

Just as with total sales, advertising on Black Friday accounted for almost a third of total sales for the week (34%), for which 22% of weekly advertising costs were spent. On Early Black Friday, it was 27% of weekly sales with 23% of weekly costs.

During Cyber Monday the advertising spend was 84% higher than on a normal day, and generated a 34% increase in sales. The best deal day from an advertising perspective was Black Friday. 284 % more revenue was generated on this day with 188% more ad spend than on an average day.

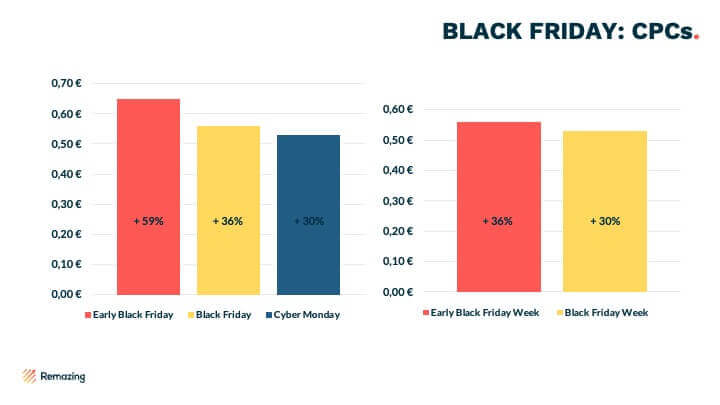

The average CPC increased by 36% from €0.41 to €0.56 in the data we looked at during Early Black Friday Week. During Black Friday Week, the click was 30% more expensive than in CW 44 and 45, peaking at 0.53€ on Black Friday. Subsequently, the CPC settled at an increased level and was also 0.53€ on Cyber Monday. This price is, however, comparably cheap: on Prime Day 2022 in June, the price per click was €0.74, 83% higher than in the previous period.

The investment in ads during the two deal weeks paid off this year. With Black Friday being the most favorable day for advertising, and Cyber Monday performing the least.

Conclusion: Overall successful Black Friday 2022

Despite current economic challenges, the Black Friday performance on Amazon was strong, according to our sample.

The increase in sales via deals worked very well – customers were primarily on the lookout for deals around Black Friday, but also Early Black Friday showed to be a popular deal day. This year deals only started on the day of Early Black Friday, while in 2021 the deal event was kicked off already on Monday that week. This shortened duration of the deal event lays more focus on the deal days themselves, rather than on the period before. Placing deals and advertising in the beginning of the sales event paid off this year.

Due to the strong competition on the marketplace, the advertising costs and average CPCs rose, but noticeably less sharply than during Prime Day. Sales were very strong especially on Early Black Friday and Black Friday itself.

From the 5 biggest learnings of our analysis, we have derived recommendations for the next Black Friday:

Black Friday was the strongest deal day during the sales period with a sales increase of 352% (vs. 242% on Early Black Friday and 79% on Cyber Monday). The customers’ focus on this one day might have been a result of the overload of deal events these past months, causing a “deal-day-fatigue”. Our recommendation: Focus on the main deal days Black Friday and Early Black Friday since Cyber Monday is still the least performing deal day on the European Markets.

Cyber Monday 2022, performed comparatively weak: sales increased by “only” 79% compared to an average day. This could be a consequence of the current economic pressure on consumers, leading them to focus on the earlier deals, leaving them with little budget for the last deal day. Our recommendation: Place offers rather early in the deal period – hence on Early Black Friday and Black Friday.

Conversion rates decreased during the deal period, and especially on Early Black Friday with a drop of 10%. At the same time glance views increased strongly, to up to 172% on Black Friday. Our recommendation: Do not be misled by declining conversion rates – the traffic on the PDPs, with and without deals increased sharply. Therefore, it is advisable to maintain and optimize all PDPs, especially during the weeks surrounding Black Friday.

Advertising achieved the best results up to and including Black Friday; here, too, sales were concentrated on the two individual days of Early Black Friday (+ 254%) and Black Friday (284%). ACoS was best on Black Friday (- 25%) and worst on Cyber Monday (+ 38%). Our recommendation: Making higher investments in ads especially up to and including Black Friday.

Compared to other, previous Deal events such as the Prime Early Access Sale, the results of Black Friday 2022 were not disappointing. While Singles Day performed strongly this year, it seemingly did not interfere too much with the BF performance. Our recommendation: Black Friday remains a very relevant deal event on Amazon that brands should definitely participate in.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH