Amazon Ends Vendor 1P Partnerships with Distributors

Big changes are expected for distributors using Amazon’s 1P platform in Europe. By all accounts, Amazon is trying to reduce its dependence on intermediary distributors with Vendor Central accounts.

Amazon’s Official Communication

This decision was initially communicated by Amazon to those concerned in a somewhat short message, with no precise reasons being cited. Company spokespersons later briefly elaborated on some of the reasons for this decision. According to these statements, 2 identified objectives for the company were behind the decision: to cut internal costs and to guarantee competitive prices for the end consumer.

The original message sent by Amazon is below:

The full comment from Amazon’s PR department was as follows:

The obvious benefit for Amazon in terms of profitability is clear. By eliminating “the middlemen”, it should be possible to increase the margins of orders placed with existing vendors, since these purchases come directly from manufacturers.

Amazon’s Reasons

The result of this choice is transparent: Non-exclusive distributors for a given product will no longer be able to sell it via their privileged position as a vendor.

But where does this decision come from? Every year Amazon suffers more and more from a profitability problem affecting its retail division. This increased emphasis on direct partnerships with brand manufacturers is not an overnight change; Amazon Retail has been moving in this direction for some time.

The results of recent quarters have led to an acceleration of this trend and, eventually, the ultimatum that we read about in recent weeks.

The need to improve profitability, especially in terms of existing costs, resulted in Amazon laying off as many as 18,000 workers in January. The top management of the American e-commerce giant also implemented a hiring freeze and prematurely terminated several of its projects that were still in the experimental phase.

All these changes, in short, are indications of Amazon’s quest for greater profitability. Although sales turnover is steadily rising, it remains lower than the company’s internal estimates.

Is There a Glimmer of Hope for 1P Distributors from Remazing’s Point of View?

If 1P distributors already have an exclusive agreement with the owners of the distributed brands, it will theoretically still be possible to sell on Amazon via Vendor Central. Even if this is not the case, it could still be possible for distributors to negotiate an exclusivity agreement for sales on the channel with the brands in question. These are the only instances in which Amazon’s recent decision could prove to have nearly zero impact for all parties involved.

In the event that an exclusivity agreement is lacking, the last resort for retailers would be to move to the marketplace side of Amazon. Joining Seller Central would enable a 3P collaboration on the channel. Selling on Amazon as a Seller is an entirely different game, however – with many different changes. Via the following link, you can find Remazing’s article on Vendor vs Seller that goes into detail on the subject.

In this specific scenario it may not be a suitable solution for two reasons:

- Bulkier products and/or those with low price points risk being unprofitable when sold with Amazon Seller and making use of Amazon’s logistics.

- Sellers have less “authority” than vendors when it comes to winning the BuyBox, especially in the case of newer sellers that do not have a significant number of positive customer reviews backing them up.

These two aspects are likely to have a considerable impact on the turnover that can be generated on Amazon for a former 1P seller. The former point seeks to orient sellers into becoming focused purely on multipacks and/or more niche products, targeting a smaller audience. The second issue, on the other hand, puts more of a brake on short term revenue, while sellers fight for the BuyBox, with prospects for improvement in the medium to long term once they become more established.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

A Look at the Current Situation for Brand Vendors

First-party brands have already been facing a relationship crisis with Amazon in recent months: The already tough-negotiations with Amazon have become even more “rigid”. Brands are more often than not faced with contractual demands from Amazon that are not economically sustainable in the long run. Rejecting these conditions risks leading to products being delisted on ground of unprofitability, and increased availability problems for the end shopper.

The Impact of Amazon’s Decision on Negotiations Between Brands and Amazon Vendor Managers

Over the years, several brands, perhaps driven by a honeymoon spirit with their initial Amazon success, have underestimated the annual negotiations. Too many concessions and too few demands have led to margin compression year on year.

Given the recent profitability crisis, Amazon is trying to slash costs, making negotiation a much tougher prospect for brand vendors. Amazon is well aware of the weight it exerts on brands’ ecommerce revenues; by cancelling POs or changing order quantities and frequency, it can heavily influence negotiations with vendor partners.

In this context, Amazon’s renewed approach to 1P retailers will certainly benefit some brands, especially those dealing in consumer packaged goods (CPG) and FMCG. These sectors are expected to benefit from greater alignment of consumer prices across channels; this will be even more evident on lower price range references, which are often unprofitable for 3P sellers. At the same time, however, this move will expose many brands to the chance of greater losses (in terms of turnover, visibility, and marketplace relevance) in the event of order changes or cancellations during negotiations. Currently, during these critical situations, the product is still sold by distributors. With this change, however, it could simply become listed as ‘unavailable’ on the marketplace.

Amazon seems to have an increasingly firm approach to negotiations with brands, with fewer and fewer concessions on their initial proposal for the year. The damage is likely to be even greater for small and medium-sized brands; these companies often have no direct contact with Amazon vendor managers. Therefore, having to deal with a de facto negotiation with an algorithm, leaving hardly any room for manoeuvres on the term.

Protection of Manufacturers or more Negotiating Power?

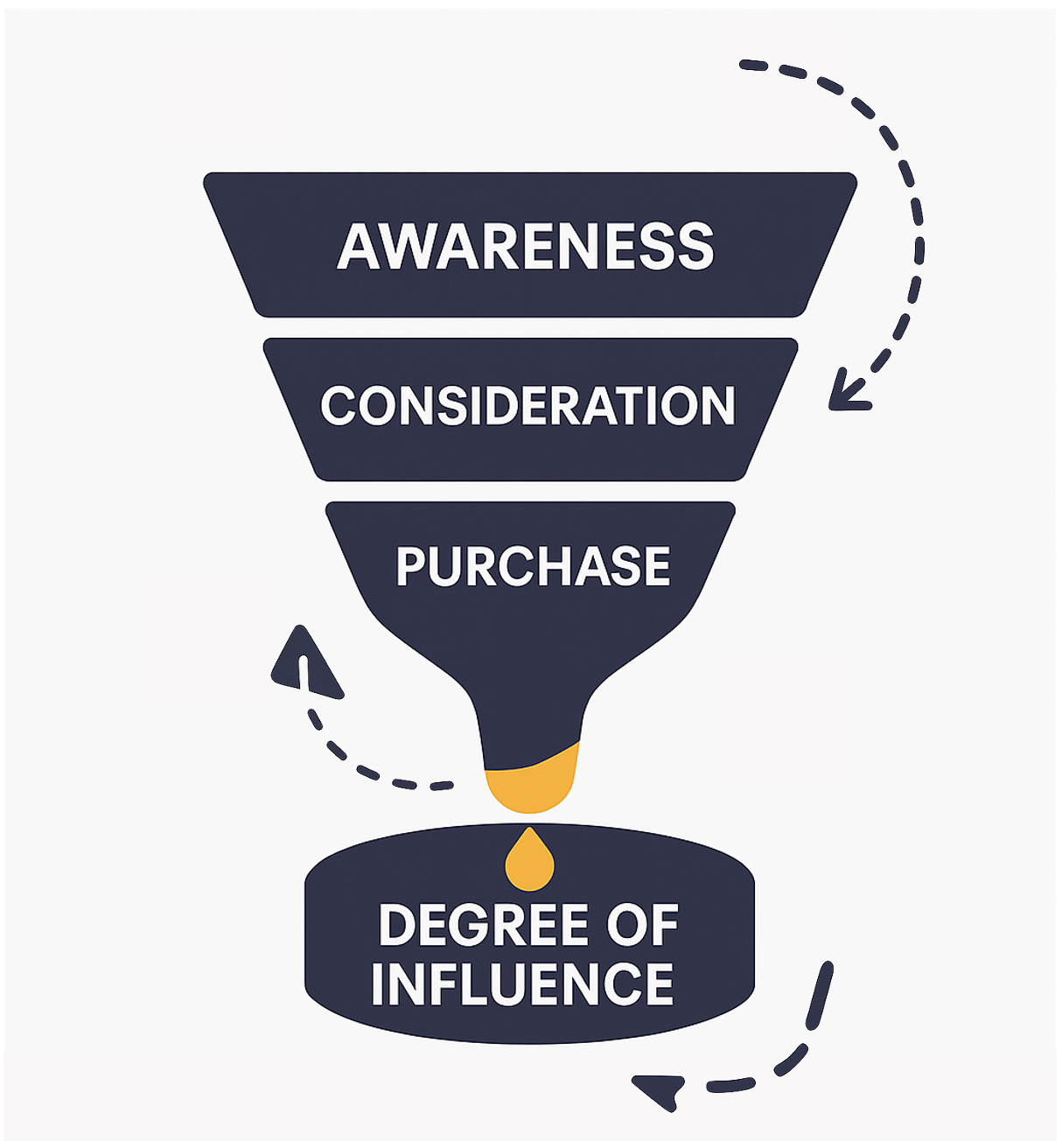

The motive for Amazon’s choice is not purely the romanticised notion of protecting brands more whilst raising the quality of 1P partnerships. Instead, it appears to be a strategy thought out to allow the platform to gain a greater degree of bargaining power. In addition to this, Amazon will also benefit in terms of price supervision and assortment management. The 1P brands that will suffer the least will be those that move the needle for Amazon; in other words those that prove to help drive increased traffic and profits.

The Alternative: a Hybrid Model Approach

What do we suggest 1P vendor brands do in order to realise the benefits of not having 1P distributors, while at the same time avoiding giving too much bargaining power to Amazon? We have two pieces of advice:

- Make profitability and channel turnovers more stable by developing exclusive listings and/or bundles.

- Go down the alternate routes in parallel with the vendor by setting up an Amazon Seller account.

Developing exclusive listings often requires a great deal of effort and general company-wide coordination. Moreover, it is not always possible due to production limitations. Companies that cannot afford to undertake this strategy should therefore opt to create an account in Amazon’s Seller Central. The use of a hybrid model is theoretically a move that the e-commerce departments of vendor brands can implement more independently.

Businesses selling via the 3P model have recently become more profitable for Amazon and have overtaken Retail in terms of generated revenue. Amazon has supported this rebalancing by providing sellers with more and more tools for optimising content, graphics, and brand protection, In addition, certain types of reports and insights are exclusively accessible on Seller Central and cannot be activated on Vendor Central. Sellers also have the same advertising features available to Vendors on Amazon.

Seller Accounts on Amazon: Limitations and Opportunities

As is to be expected, the Seller model has several limitations, namely:

- Different cost structure. There is no annual contract, but a percentage cost system in place on each sale. This system makes it unprofitable to sell single packs of low – medium priced products (e.g. consumer-packaged goods), especially if they are comparatively large for their value (think, for example, of a 500g pack of pasta). These percentages also remain the same, no matter the turnover generated by the seller.

- Lower level of authority. Being in 1P means having your products labelled as ‘Sold and Shipped by Amazon’. By contrast, a Seller account will need time to build a more trustworthy reputation in the eyes of users, gaining visibility in SERPs and more BuyBox wins.

If properly developed, a Seller account can be a great ally in generating revenue on Amazon, especially in tough trading times. For a CPG brand, it could represent a hidden opportunity to sell multipacks, bundles, and premium lines on more favourable terms than you might find elsewhere as a business wanting to sell on Amazon.

What we recommend, however, if you want to consider this route, is to move in good time and with a thorough understanding of the hybrid model. In fact, the complexities of running a hybrid model mean it isn’t a decision to take lightly.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH