Holiday Season 2022 in E-Commerce: U.S. vs Europe

Recently, Insider Intelligence published their predictions for this year’s “US Cyber Five Retail E-Commerce Holiday Season Sales” (see graph below) and the upcoming holiday season which were overall rather positive. Consumer spending remains strong – though mostly due to inflation.

Due to continuing economic uncertainty, e-commerce started off this year’s holiday season with unclear expectations. These numbers indicate that things are going better than expected especially in the U.S. – probably because consumers want to save money by using deals more than before. With Christmas approaching, these next weeks will show, whether this remains to be true.

2022 Holiday Season in European E-Commerce

Insider Intelligence based their holiday season consumer spending predictions for the U.S. on the so-called “four disruptive forces”. In order to predict the spending of European shoppers during this year’s holiday season, the following analyzes at the potential impact of these four forces on European E-Commerce.

Force 1: Rising Inflation vs. Disposable Income

As stated above, Black Friday and Cyber Monday 2022 in the U.S. reported record-breaking performances. For the whole Holiday Season in the U.S., experts are “cautiously optimistic” and expect 2.5% growth year-over-year.

Our own analysis of the Amazon EU5 markets (Spain, Germany, UK, France, and Italy), conducted via Remdash, shows that both Early Black Friday and Black Friday were significantly stronger this year than in 2021. Cyber Monday was the weakest deal day and even saw a year-on-year decline in sales growth. This alignes with study results by YPulse, indicating that Cyber Monday is less popular among Europeans than Black Friday. We furthermore see that European Shoppers show the tendency to save up money in preparation for deal events such as Black Friday, which likely influenced the deal-day performance in EU5 positively.

Looking at the coming weeks, however, we see that consumer spending in the EU5 reflects the impact of the challenging global economic situation, resulting in inflation and rising costs of everyday goods. Recent data analyzed by Reuters, furthermore suggests that European shoppers are inclined to cut back on expenditures for Christmas gifts this year. These factors will certainly impact this year’s holiday season sales. Overall, however, the performance of the European e-commerce this holiday season is likely to lag behind the success of the U.S. presumably due to a comparably strong dollar and European core markets suffering more from inflation and the energy crisis.

Force 2: Demand for Experiences vs. Demand for Retail Goods

Insider Intelligence’s concern of a stronger post-pandemic demand for experiences over retail goods after “spending heavily” on the latter during the past two years, seems plausible at first. However, in opposition to Insider Intelligence’s claims for the U.S., many European households affected by covid-related circumstances such as sudden job loss and economic uncertainty, have abstained from such heavy spending on physical goods during the “hot phase” of the pandemic. Post-pandemic, they might be more inclined to make bigger purchases.

Subscribe to our newsletter now and receive regular updates on Amazon and other online marketplaces.

Subscribe to the newsletter now.

There is however a growing wave of “consumer pessimism,” detected by Mckinsey&Company, which is likely to negatively impact spending behavior this holiday season. This leaves us with overall quite mixed feelings towards consumer spending in regards to retail goods this holiday season. In summary, we do see a willingness to purchase physical goods in Europe, but it is chastened by the economic crisis and is likely to draw e-commerce sales down. Consequently, we see an interesting globlal trend: consumers are increasingly planning to purchase second-hand or through reselling platforms – which is reflected in current marketplace developments & launches.

Force 3: Product Demand vs. Product Availability

Supply chain issues in Europe have made headlines since March this year, and associated challenges are certainly no news for anyone working in e-commerce. Next to global factors such as inflationary pressure, the Ukraine war, the energy crisis, or China’s ongoing zero-COVID policy, Europe-specific issues, such as rail, port, and mail strikes, are likely to affect product availability the coming weeks and months.

Generally, products with shorter supply chains are less likely to pose difficulties. Additionally, the situation with the ports continues to recover after a turbulent 2022 – and due to the omnipresence of supply chain issues this year, retailers have found their tweaks to deal with shortages and the communication thereof.

Force 4: Longer Calendar vs. Promotional Day Fatigue

This year’s holiday season consists of 11 weeks and encompasses many marketplaces and online shops trying to lure in consumers with discounts and incentives. The Prime Day, Prime Early Access Sales, Black Friday, Cyber Monday, and many more overwhelm US-American shoppers, according to Insider Intelligence. This overload of deals likely eliminates the chance to stand out.

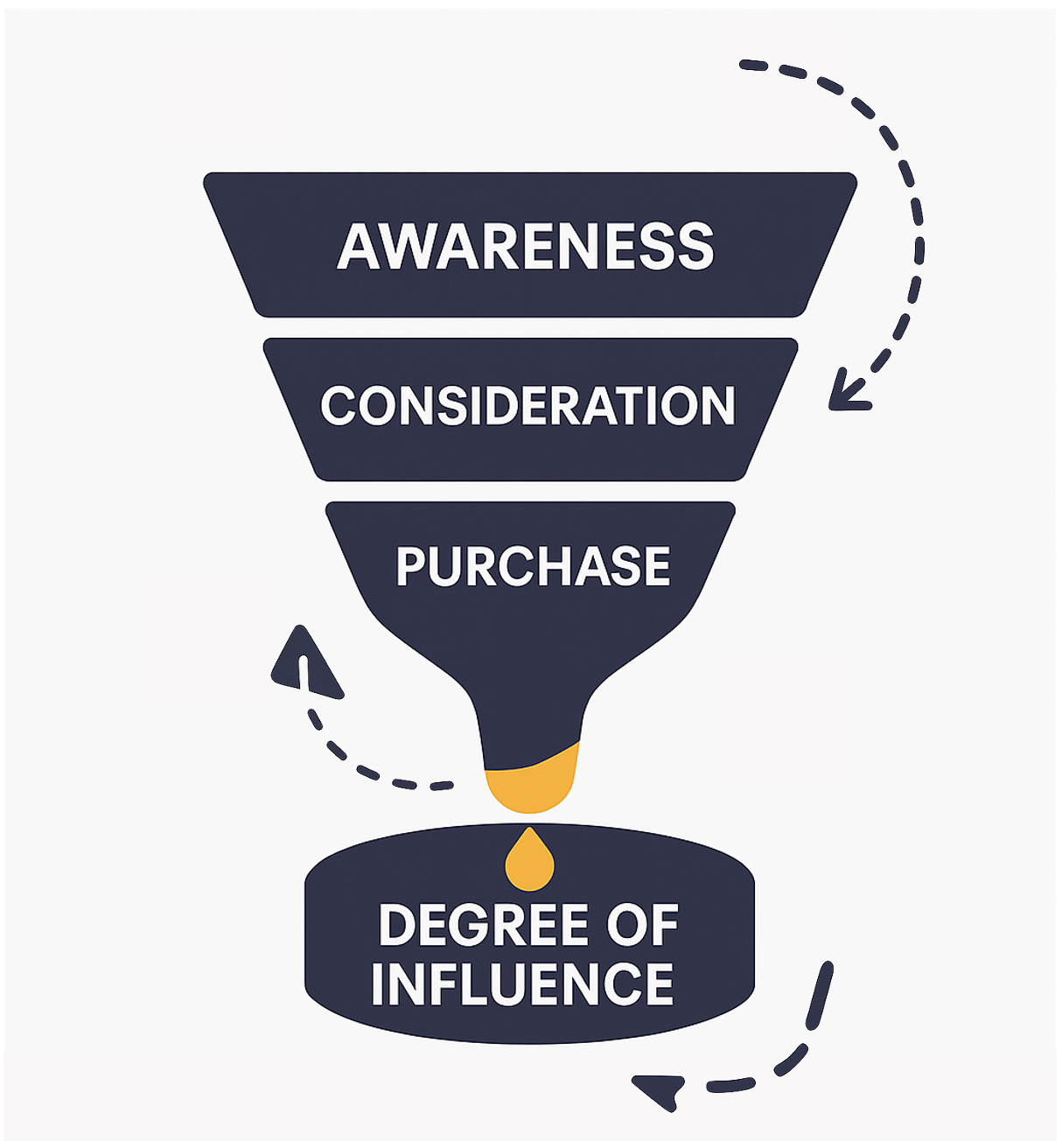

Experts indicate that, this applies to European consumers as well. To stand out will be challenging, so we recommend a data-based full-funnel marketing strategy to make sure consumers know about your offers. A brand’s website, online shop, social media channels and their Amazon presence should go hand in hand here. The key word here is consistency.

Our Recommendations: How to Deal with These Forces?

There is no doubt that this year’s holiday season proposes many challenges. Although it might not be as difficult as predicted by some, the actual performance will be influenced by many factors. Here are our recommendations for the upcoming holiday season:

- Brands can accommodate consumers faced with inflation and rising costs of living by providing special sale offers such as bundles. Another option for accommodation, is Amazon’s Subscribe & Save program, which allows customers to sign up for scheduled deliveries of the products they frequently order with free shipping and discounted pricing.

- We recommend integrating resale strategies into business processes, in order to meet the growing demand for sustainable options, handle the holiday season inundation of returns, and move away from disposable products.

- Stay informed about potential supply chain issues and make sure to communicate whether customers can expect their product on time. An extra tip: a product’s arrival in time for Christmas can also be communicated as a benefit or USP.

- In order to cut through the clutter, we advise looking at Amazon’s advertising options, including those that reach potential customers outside of Amazon, such as DSP and its re-targeting options.

Are you interested in an expert analysis of your Amazon account?

Request free analysisRelated articles

Remazing GmbH

Brandstwiete 1

20457 Hamburg

©Remazing GmbH